[ad_1]

As if wasn’t already powerful sufficient to make a serious buy at a time when residing prices are skyrocketing, the rates of interest to finance these dear purchases are going up.

Now customers are confronting a troublesome query: Ought to they pause their searches for brand new homes, automobiles and different big-ticket objects within the hope that rates of interest will fall each time inflation is reined in?

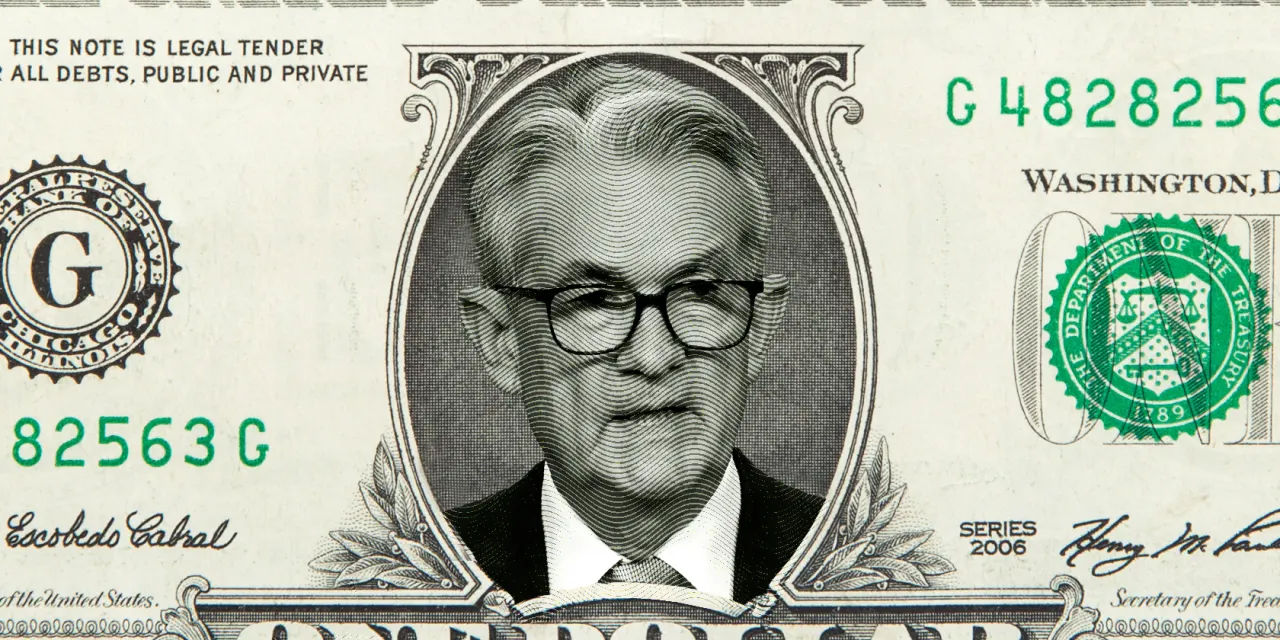

It’s a query that good points urgency with each Federal Reserve assembly a couple of key rate of interest. The central financial institution introduced its newest charge determination Wednesday afternoon, a widely-expected 75-basis level enhance that’s the fourth straight hike this yr.

Think about the charges individuals are already staring down.

For a house, a potential purchaser faces a 5.54% charge on a 30-year fixed mortgage, Freddie Mac

FMCC,

-2.40%

mentioned final week. That was up from 2.76% a yr in the past.

For a brand new automobile, five-year auto loans climbed to 4.86% in late July, up from 4.47% in April, based on Bankrate.com.

Even for the on a regular basis items and providers an individual places on their bank card, the charges are climbing.

In the course of the second quarter, annual proportion charges reached 15.13%, up from 14.56% within the first quarter, based on LendingTree. This month, the common charge on all new bank cards is 20.82%, up from 20.17% a month in the past.

The Ate up Wednesday signaled nonetheless extra will increase for the federal funds charge, which influences the rates of interest lenders cost folks shopping for houses, automobiles or utilizing a bank card. The Fed had already boosted the federal funds charge 3 times since March.

Fee cuts may begin early subsequent yr, according to some Fed watchers — however that’s a guessing game. For proper now, it’s the fastest pace of tightening since 1981.

The Fed’s charge hikes are imagined to throw chilly water on scorching inflation charges, on the speculation that steeper borrowing prices sluggish client demand. Whereas the Fed presses on with its plans, some individuals are deciding whether or not to press on with their big-ticket spending plans.

It’s a query monetary planner Cecil Staton has been more and more listening to from purchasers since early this yr. “They’re getting scared or getting involved if they’re making the best determination,” mentioned Staton, founding father of Arch Monetary Planning in Athens, Ga.

After questions on stock market turbulence, Staton says the largest query purchasers have is whether or not to maneuver ahead or wait on rate-sensitive transactions comparable to home purchases.

The query on learn how to proceed in a rising-rate atmosphere is “positively a much bigger query on high of individuals’s thoughts that they must weigh as a possible price,” mentioned Caleb Pepperday, a wealth advisor at JFS Wealth Advisors, headquartered in Hermitage, Penn.

There are indicators that increased prices, together with rates of interest, are sidelining some potential consumers.

Current residence gross sales in June missed expectations and marked the fifth straight month of decline. House worth progress in main cities came off record highs in Could.

Estimated second quarter new automobile gross sales, whereas up 5.1% from the earlier quarter, are down practically 21% from the yr earlier than, based on Edmunds.com.

In the meantime, three in 10 folks had been planning to purchase a brand new automobile this yr, however 60% of the would-be consumers had been reconsidering or pausing altogether, based on a Quicken survey this month. Two in 10 folks had been contemplating a house buy this yr, however roughly 70% referred to as it off. Rising rates of interest was one of many components taking part in into folks’s shifting selections, the survey famous.

A significant spending determination is a large choice in any context — not to mention at a degree when inflation is at a 41-year high and discuss continues of a potential recession. Right here’s what to think about in case you are pausing a seek for a brand new automobile or residence, or dashing up the search to get forward of even increased charges.

Think about the place to maintain down cost cash. Anybody trying to halt main spending plans within the subsequent one to a few years must be extraordinarily conservative about the place they sideline money that’s earmarked for down funds and associated bills, mentioned Zachary Gildehaus, a senior analyst at Edward Jones in St. Louis, Mo. In addition they have to hold it extremely liquid, he famous.

Suppose high-yield savings accounts or cash market funds, he mentioned. If the deferred timeline skews to a few years, Gildehaus mentioned folks can “sparingly” contemplate some small funding in short-term, high-quality company bonds by way of a bond mutual fund.

Pay down money owed, particularly excessive curiosity ones. That begins with bank card payments, as a result of the APRs on bank cards are closely tied to Fed action. Carrying balances month to month will get dearer as charges hold climbing, consultants beforehand instructed MarketWatch. In fact, avoiding debt is simpler mentioned than finished when inflation is beating wage increases.

Greater than two in 10 (22%) of individuals mentioned they anticipate to tackle bank card debt within the coming six months, based on a latest LendingTree survey. One third of these folks have good FICO

FICO,

+2.35%

credit score scores starting from 670 to 739.

Keep in mind your credit score rating. When lenders decide mortgage approvals, charges and phrases, their calculations incorporate macro-level concerns about rates of interest and financial situations. However additionally they weigh the creditworthiness of debtors themselves. Excessive excellent money owed and missed funds can hurt a rating and dampen a lender’s view.

So can new strains of credit score for a serious buy within the lead as much as a mortgage, Gildehaus mentioned. It could be tempting for some folks to think about substituting issues like a automobile buy or a mortgage for a house enchancment undertaking for financing for furnishings whereas they hope for higher mortgage charges.

However timing is vital, Gildehaus famous. Mortgage lenders extend preapprovals on the applicant’s financial portrait they have in front of them and if that portrait adjustments within the lead-up to the acquisition, they will both change to much less favorable phrases or doubtlessly deny the applying, he mentioned.

Discover a method again. Staton leans towards urgent forward with greater purchases like a home now, so long as the client is financially prepared to take action. (By that he implies that you at the moment spend not more than 50% of your revenue on housing, meals and primary wants; 30% on discretionary purchases; and also you save 20%, and that on high of that you’ve got the money to cowl a 20% down cost plus closing prices, shifting bills, furnishings and different incidentals, he mentioned.)

But when would-be consumers are pausing, they need to latch onto a particular metric, like an rate of interest or an revenue quantity, that can function a threshold for once they’ll hop again into the search. “You actually simply have to select a objective and maintain your self accountable to it. The right charge, the proper home, the proper time doesn’t exist,” mentioned Staton.

Keep in mind that whenever you resume the search, it is not going to be identical. Rates of interest are one variable, and there’s no assure for when and the way shortly they may go down, Staton mentioned.

The costs on big-ticket objects received’t essentially be receding both. Housing worth appreciation is “unsustainable,” mentioned Steve Rick, chief economist at CUNA Mutual Group, a monetary providers supplier to credit score unions and their prospects. The expansion on costs will sluggish within the close to future, however affordability issues will stay, he mentioned. “Whereas rate of interest hikes are placing stress on customers, america remains to be dealing with a housing disaster,” Rick mentioned.

Automotive costs replicate the identical dynamic. In June, the standard month-to-month cost for a brand new automobile hit a record-high $730, based on a Cox Automotive/Moody’s analysis this month that components rates of interest, costs and incentives.

Don’t rush for emotion’s sake. It could be worthwhile to hurry up spending plans to get forward of even increased charges, and Pepperday has seen that occur. However irrespective of the financial backdrop, it comes again to separating wants and needs, he mentioned.

“In case you have a home or operating automobile now that works, however you ‘need’ to improve, it might be worthwhile to attend as charges will possible come down sooner or later as inflation cools,” he mentioned. If it’s a necessity, nonetheless, it’s vital to take away emotion and pinpoint what you’ll be able to afford to pay.

A method to do this is to calculate the precise month-to-month mortgage or automobile cost you’ll be able to afford, after which draw a brilliant line there; solely contemplate houses or automobiles as much as that quantity. In different phrases, Pepperday mentioned, beware the hazards of getting connected to one thing you’ll be able to’t afford and attempting to persuade your self you are able to do it.

Keep in mind the possibility for a future refinance. The rate of interest homebuyers get on their mortgage now doesn’t must be the speed they at all times have, Staton and Pepperday famous. Enter the mortgage refinance. As Staton famous, there’s a saying that circulates within the real-estate banking world: “Marry the home, date the speed.”

If an individual can afford to take the leap, he mentioned it’s value remembering the saying’s gist.

Given the place charges are, it’s not stunning to see a lull in refinances after a flurry earlier within the pandemic when charges had been at historic lows. In mid-July, one gauge on refinance exercise hit a 22-year-low as refinance functions dropped 4% week to week and had been 80% decrease than a yr in the past, according to the Mortgage Bankers Association.

On Wednesday morning, earlier than the Fed announcement, the latest mortgage refinance data confirmed a 4% drop from the earlier week and an 83% drop from the identical level a yr in the past.

Hey there! Ready to embark on a historical journey with Air India? Whether you're a…

In 2017, altcoins were seen as experimental side projects to Bitcoin. By 2021, they became…

Shopping centers in Las Vegas have a unique opportunity to stand out by offering not…

Levitra, a widely recognized medication for treating erectile dysfunction (ED), has proven to be a…

Have you ever looked down at your carpet and wondered if there’s a budget-friendly way…

Counter-Strike 2 (CS2) has elevated the thrill of case openings, captivating both seasoned CS:GO veterans…