The Federal Reserve’s technique of supersize rate of interest hikes will get a lot of the blame for triggering a bear market in shares in 2022, however buyers may be shocked by a glance again at how equites have carried out on the times this 12 months when coverage makers have slammed on the metaphorical monetary-policy brakes.

The S&P 500

SPX,

+1.52%

has fallen round 10% general since Fed Chair Jerome Powell and his colleagues started the speed climbing cycle in mid-March, or three conferences in the past, famous analysts at Bespoke Funding Group, in a notice.

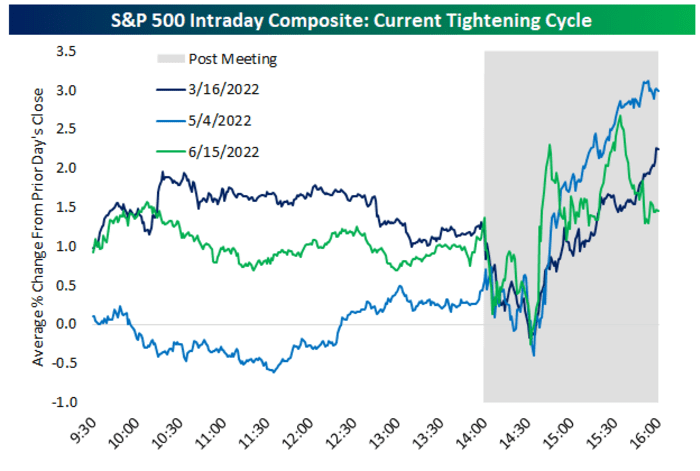

However the index, they noticed, has rallied not less than 1.5% on every of the three Fed assembly days throughout this era.

The massive-cap benchmark gained 2.2% on March 16 after Powell’s first fee hike of 25 foundation factors, or 1 / 4 of a share level. On Might 4, the S&P rose 3% after Powell’s second hike of fifty foundation factors, which was the biggest such transfer since 2002. And on the final assembly on June 15, the S&P 500 gained 1.4% on the day following a fee hike of 75 foundation factors, the biggest transfer since 1994 (see chart under).

Bespoke Funding Group

“You possibly can see that an preliminary drop occurred proper after the two PM ET fee determination all 3 times, however then shares rallied exhausting for the rest of the day as soon as Powell’s press convention started,” the analysts wrote.

Fed-funds futures merchants have priced in a 75% likelihood of one other 75 foundation level hike on Wednesday, with a roughly 25% probability of a super-size 100 foundation level transfer. The Fed will announce the end result of the two-day coverage assembly at 2 p.m., with Powell’s information convention slated to start at 2:30 p.m.

A 75 foundation level transfer seems like just about a completed deal, in accordance with Deutsche Financial institution macro strategist Alan Ruskin.

“As a substitute, the market response goes to be all concerning the messaging, and right here it will get an entire lot trickier, as a result of on each inflation and progress there will likely be some twin tacks taken, which may even sound contradictory, however are reflective of the macro complexities of the day,” he mentioned in a Tuesday notice.

Certainly, buyers are poised to listen to what Powell has to say about rising fears the financial system is slipping towards or has already slipped into recession. Some market watchers are baying for Powell to push again on market-based expectations the Fed may start reducing rates of interest once more as early as subsequent 12 months and that the fed-funds fee is prone to high out beforehand close to 3.5%.

Key Phrases: Here’s what Bill Ackman says Powell should tell traders about Fed rate-hike plans

Powell will try to keep away from contradicting the Biden administration’s denials that the economy is in recession and notice that they’re typically exhausting to acknowledge in actual time, Ruskin mentioned, whereas observing that the slowing seen thus far doesn’t appear like a typical recession given the energy of the labor market thus far.

Rex Nutting: Everything you need to know about the economic recession that we are definitely not in right now

Ruskin expects a lot of the response to the Fed determination to be pushed straight by the signaling for the September assembly.

Whereas buyers will deal with the query of a 50- versus a 75-basis-point fee hike, the market has priced in a cumulative 136 foundation factors of tightening for July and September, Ruskin mentioned, “which seems affordable, and, shouldn’t be one thing the Fed will exit of their method to fine-tune.”

A need to not be express and shift short-term charges signifies that the July assembly gained’t function a “differentiating sentence from Powell that units the tone for all markets,” Ruskin mentioned. “What Powell will be capable of say is that the Fed continues to be homing in on a coverage fee that’s reasonably tight relative to their impartial fee, and the upper the extent of charges, the extra incremental fee modifications may be smaller than 75bps.”

The twin message on charges will seemingly be that the Fed is open minded

on a 50- or 75 foundation level transfer in September and that it’s too quickly to make that decision, Ruskin mentioned, whereas there could also be some pushback on market expectations for a peak fee close to 3.4%.

Shares have been pointing to the upside forward of the Fed determination Wednesday, with the S&P 500 up 1.3%, whereas the Dow Jones Industrial Common

DJIA,

+0.45%

rose round 125 factors, or 0.4%, and the Nasdaq Composite

COMP,

+2.78%

jumped 2.4% as tech heavyweights Microsoft Corp.

MSFT,

+5.24%

and Alphabet Inc.

GOOG,

+6.99%

GOOGL,

+7.05%

rallied after earnings.