Semiconductor shares have been hit arduous, however many are poised for fast progress. Listed below are 15 anticipated to shine via 2024

[ad_1]

In December, we listed analysts’ favourite semiconductor shares for 2022. That hasn’t turned out effectively.

However after chipmakers’ shares have been hammered, the group is now buying and selling at “normal-level valuations,” based on Matt Peron, director of analysis at Janus Henderson Traders. For long-term buyers, it could assist to see which firms within the sector are anticipated to develop most quickly over the subsequent two years.

Peron, in an interview, stated one motive for this 12 months’s decline for semiconductor shares was that they’d had a great, future, stretching valuations. “Semiconductors are cyclical,” he stated. In his position, Peron and his staff present recommendation to many portfolio managers, together with these of the Janus Henderson Know-how and Innovation Fund

JATIX.

One of many greatest gamers, Intel Corp.

INTC,

will publish second-quarter outcomes on July 28 after the market shut. Here’s a preview.

This house could be very a lot in play, with the Senate just passing a bill that features $52.7 billion in subsidy for the semiconductor trade. The invoice passes to the Home of Representatives which can observe swimsuit this week. President Joe Biden has expressed assist for the invoice.

Cheaper than the S&P 500

The stock-market benchmark for this nook of the expertise sector is the PHLX Semiconductor Index

SOX,

which is made up of 30 shares of U.S.-listed makers of pc chips and associated manufacturing tools and is tracked by the iShares Semiconductor ETF

SOXX.

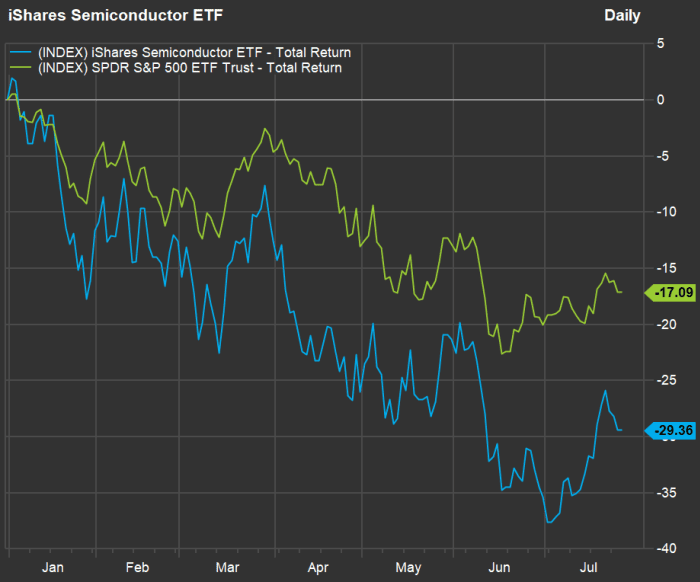

This 12 months’s motion for SOXX seems to be ugly, when in comparison with the motion of the SPDR S&P 500 ETF

SPY

:

The iShares Semiconductor ETF has fallen a lot additional than the SPDR S&P 500 ETF has throughout 2022.

FactSet

The above chart reveals year-to-date whole returns with dividends reinvested via July 26.

Peron stated the bumpier experience for semiconductors resulted from “a mixture of excessive valuations and, partly, the burden of the Federal Reserve coming down on the economic system” with interest-rate will increase to cut back inflation.

When requested concerning the chip scarcity that has affected the auto trade and others, he stated: “The demand can and can gradual, given that there’s a lot of stock within the channel.”

Regardless of the semiconductor group’s better volatility, it has carried out a lot better than the benchmark has over lengthy intervals. Listed below are common annual returns:

| ETF | Common return – 3 years | Common return – 5 years | Common return – 10 years | Common return – 15 years |

| iShares Semiconductor ETF | 22.0% | 21.7% | 23.8% | 13.6% |

| SPDR S&P 500 ETF Belief | 10.8% | 11.5% | 13.3% | 8.8% |

| Supply: FactSet | ||||

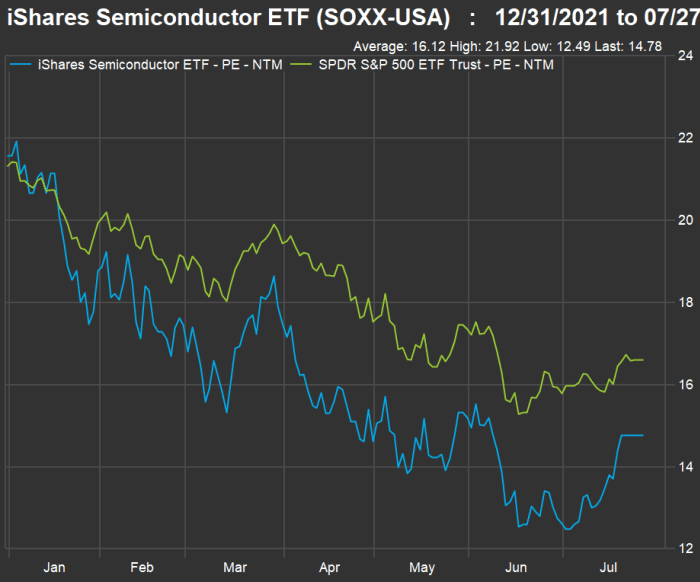

Now have a look at this 12 months’s motion of ahead price-to-earnings ratios, based mostly on weighted rolling consensus 12-month earnings estimates for the 2 teams:

After starting 2022 buying and selling larger to ahead earnings estimates than SPY did, SOXX now trades significantly decrease than the benchmark.

FactSet

On the finish of 2021, SOXX traded for 21.6 occasions anticipated earnings, barely above SPY’s ahead P/E of 21.3. However SOXX now trades at a ahead P/E of 14.8, effectively beneath SPY’s ahead P/E of 16.6.

Right here’s a have a look at common P/E for the 2 teams over the previous 10 years:

| ETF | Present ahead P/E | 10-year common ahead P/E | Present valuation to 10-year common | Present valuation to SPY | 10-year common valuation to SPY |

| iShares Semiconductor ETF | 14.78 | 16.55 | 89% | 89% | 98% |

| SPDR S&P 500 ETF Belief | 16.61 | 16.96 | 98% | ||

| Supply: FactSet | |||||

The semiconductors as a gaggle are buying and selling at a better low cost to the S&P 500 than has been typical over the previous 10 years.

“ For buyers with two- or three-year horizons, semiconductors could also be a great way to allocate capital .”

Ought to the chip makers be buying and selling at a reduction to the S&P 500? Listed below are projected compound annual progress charges (CAGR) for gross sales, earnings and free money stream (FCF) per share for the 2 teams via 2024:

| ETF | Ticker | Anticipated gross sales CAGR – 2022 via 2024 | Anticipated EPS CAGR – 2022 via 2024 | Anticipated FCF CAGR – 2022 via 2024 |

| iShares Semiconductor ETF | SOXX | 9.0% | 6.9% | 10.2% |

| SPDR S&P 500 ETF Belief | SPY | 4.9% | 8.1% | 10.7% |

| Supply: FactSet | ||||

The semiconductor group is anticipated to develop gross sales far more quickly than the S&P 500. Nonetheless, the complete benchmark index is anticipated to point out higher earnings progress and a barely higher enhance in free money stream.

So the semiconductors as a gaggle seem like a combined bag when contemplating their comparatively low-cost valuation to the S&P 500 and the 2 teams’ progress estimates. Let’s dig additional into the semiconductor house.

Screening semiconductor shares

For a broad display screen of semiconductor shares, we started with the SOXX 30 however then added firms within the S&P Composite 1500 Index

XX:SP1500

(made up of the S&P 500

SPX,

the S&P 400 Mid Cap Index

MID

and the S&P Small Cap 600 Index

SML

) within the “Semiconductors and Semiconductor Tools” International Industrial Classification Normal (GICS) trade group.

We regarded inside the S&P Composite 1500 as a result of it screens-out newer firms that haven’t achieved constant profitability. Normal & Poor’s criteria for preliminary inclusion within the index contains constructive earnings for the latest quarter and for the sum of the latest 4 quarters.

Our preliminary group included 56 firms, which we narrowed to the 37 for which consensus gross sales estimates had been accessible via 2024 amongst no less than 5 analysts polled by FactSet. We used calendar-year estimates — a number of the firms have fiscal years that don’t match the calendar.

Listed below are the 15 firms are anticipated to attain the very best gross sales CAGR from 2022 via 2024:

| Firm | Ticker | Projected gross sales CAGR | Ahead P/E | Ahead P/E as of Dec. 31, 2021 | Market cap ($mil) |

| Wolfspeed Inc | WOLF | 36.8% | 347.7 | N/A | $9,414 |

| First Photo voltaic Inc. | FSLR | 28.8% | 54.9 | 44.2 | $7,841 |

| Enphase Power Inc. | ENPH | 26.4% | 50.8 | 60.1 | $29,180 |

| SolarEdge Applied sciences Inc. | SEDG | 23.8% | 45.9 | 54.0 | $16,421 |

| Common Show Corp. | OLED | 18.6% | 21.8 | 31.8 | $5,129 |

| SiTime Corp. | SITM | 17.9% | 35.6 | 85.3 | $3,556 |

| Marvell Know-how Inc. | MRVL | 17.0% | 18.9 | 40.6 | $42,053 |

| SunPower Corp. | SPWR | 16.4% | 33.7 | 44.3 | $2,761 |

| Silicon Laboratories Inc. | SLAB | 16.3% | 34.9 | 89.7 | $5,068 |

| ASML Holding N.V. ADR | ASML | 16.1% | 29.4 | 41.2 | $213,062 |

| Nvidia Corp. | NVDA | 15.3% | 28.5 | 58.0 | $413,325 |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | TSM | 14.6% | 13.4 | 24.3 | $437,809 |

| Teradyne Inc. | TER | 14.3% | 17.3 | 25.2 | $15,724 |

| Monolithic Energy Techniques Inc. | MPWR | 13.9% | 33.4 | 57.9 | $19,688 |

| Superior Micro Gadgets Inc. | AMD | 13.4% | 18.7 | 43.1 | $138,148 |

| Supply: FactSet | |||||

Click on on the tickers for extra about every firm.

You must also read Tomi Kilgore’s detailed information to the wealth of data at no cost on the MarketWatch quote web page.

Small and mid-cap firms dominate the checklist. Nonetheless, it additionally contains trade giants corresponding to ASML Holding N.V.

NL:ASML,

Nvidia Corp.

NVDA,

Taiwan Semiconductor Manufacturing Co.

TSM

and Superior Micro Gadgets Inc.

AMD.

Ahead P/E ratios might be very excessive for a few of these firms, corresponding to WolfSpeed Inc.

WOLF,

due to low near-term revenue expectations. For probably the most half, the P/E ratios have declined significantly. A notable instance is Nvidia, with a ahead P/E of 28.5, in contrast with 58 on the finish of 2021.

We haven’t included CAGR for EPS or FCF for the person firms as a result of low or unfavorable numbers within the early intervals can distort progress figures or make them not possible to calculate. So listed below are calendar-year EPS estimates and projected EPS CAGR for the group, if accessible:

| Firm | Ticker | Estimated EPS – 2024 | Estimated EPS – 2023 | Estimated EPS – 2022 |

| Wolfspeed Inc | WOLF | $2.12 | $0.91 | -$0.24 |

| First Photo voltaic Inc. | FSLR | $4.21 | $2.13 | $0.29 |

| Enphase Power Inc. | ENPH | $5.51 | $4.58 | $3.77 |

| SolarEdge Applied sciences Inc. | SEDG | $10.23 | $7.91 | $4.56 |

| Common Show Corp. | OLED | $7.14 | $5.32 | $4.53 |

| SiTime Corp. | SITM | $5.30 | $5.06 | $4.35 |

| Marvell Know-how Inc. | MRVL | $3.52 | $2.86 | $2.27 |

| SunPower Corp. | SPWR | $0.98 | $0.64 | $0.25 |

| Silicon Laboratories Inc. | SLAB | $5.33 | $4.22 | $3.63 |

| ASML Holding N.V. ADR | ASML | $24.05 | $20.29 | $14.51 |

| Nvidia Corp. | NVDA | $7.19 | $6.18 | $5.27 |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | TSM | $7.44 | $6.41 | $6.13 |

| Teradyne Inc. | TER | $7.19 | $6.33 | $4.77 |

| Monolithic Energy Techniques Inc. | MPWR | $14.05 | $13.44 | $11.57 |

| Superior Micro Gadgets Inc. | AMD | $5.92 | $4.77 | $4.31 |

| Supply: FactSet | ||||

And FCF-per-share estimates:

| Firm | Ticker | Estimated FCF – 2024 | Estimated FCF – 2023 | Estimated FCF – 2022 |

| Wolfspeed Inc | WOLF | $0.18 | -$2.21 | -$4.69 |

| First Photo voltaic Inc. | FSLR | $1.32 | $0.27 | -$6.48 |

| Enphase Power Inc. | ENPH | $6.54 | $4.97 | $4.21 |

| SolarEdge Applied sciences Inc. | SEDG | $7.50 | $7.13 | -$0.01 |

| Common Show Corp. | OLED | N/A | $5.53 | $4.54 |

| SiTime Corp. | SITM | N/A | N/A | N/A |

| Marvell Know-how Inc. | MRVL | $3.05 | $2.55 | $2.01 |

| SunPower Corp. | SPWR | N/A | N/A | N/A |

| Silicon Laboratories Inc. | SLAB | $4.25 | $3.94 | $4.27 |

| ASML Holding N.V. ADR | ASML | $20.67 | $18.20 | $14.15 |

| Nvidia Corp. | NVDA | $5.93 | $6.12 | $4.59 |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | TSM | $4.55 | $3.28 | $2.24 |

| Teradyne Inc. | TER | N/A | $6.33 | $3.69 |

| Monolithic Energy Techniques Inc. | MPWR | $12.91 | $10.52 | $8.35 |

| Superior Micro Gadgets Inc. | AMD | $5.03 | $4.23 | $3.40 |

| Supply: FactSet | ||||

Here’s a abstract of opinion amongst analysts polled by FactSet:

| Firm | Ticker | Share “purchase” rankings | Share impartial rankings | Share “promote” rankings | Closing value – July 26 | Consensus value goal | Implied 12-2month upside potential |

| Wolfspeed Inc | WOLF | 56% | 33% | 11% | $76.14 | $102.38 | 34% |

| First Photo voltaic Inc. | FSLR | 25% | 62% | 13% | $73.57 | $79.44 | 8% |

| Enphase Power Inc. | ENPH | 71% | 26% | 3% | $216.10 | $247.52 | 15% |

| SolarEdge Applied sciences Inc. | SEDG | 77% | 19% | 4% | $296.48 | $359.75 | 21% |

| Common Show Corp. | OLED | 75% | 17% | 8% | $108.64 | $170.09 | 57% |

| SiTime Corp. | SITM | 100% | 0% | 0% | $169.02 | $263.00 | 56% |

| Marvell Know-how Inc. | MRVL | 88% | 12% | 0% | $49.48 | $79.17 | 60% |

| SunPower Corp. | SPWR | 16% | 63% | 21% | $15.88 | $19.72 | 24% |

| Silicon Laboratories Inc. | SLAB | 42% | 58% | 0% | $138.54 | $162.89 | 18% |

| ASML Holding N.V. ADR | ASML | 79% | 15% | 6% | $524.17 | $628.71 | 20% |

| Nvidia Corp. | NVDA | 82% | 16% | 2% | $165.33 | $237.50 | 44% |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | TSM | 92% | 8% | 0% | $84.42 | $115.36 | 37% |

| Teradyne Inc. | TER | 57% | 43% | 0% | $98.15 | $125.94 | 28% |

| Monolithic Energy Techniques Inc. | MPWR | 92% | 8% | 0% | $422.11 | $551.44 | 31% |

| Superior Micro Gadgets Inc. | AMD | 68% | 29% | 3% | $85.25 | $125.76 | 48% |

| Supply: FactSet | |||||||

Source link