Opinion: Vitality shares have a sustainable future: it is of their dividends

[ad_1]

One of many few numbers rising sooner than vitality inventory dividends is the dimensions of crowds satisfied they aren’t sustainable. I’ve by no means witnessed a consensus opinion as detrimental on a whole sector as on conventional vitality.

The debates are so one-sided that dividends’ easy clues are being neglected, and as a substitute extra focus is positioned on when conventional vitality companies will stop to exist.

But dividends supply traders higher proof of precisely what’s working than any crowds. As knowledgeable portfolio supervisor since 1996, I’ve studied each conceivable issue of investing success, and I’ve discovered no different metric with as lengthy a observe report. A dividend is delivered freed from opinions about what’s actual — and that’s much more beneficial when confusion about vitality shares is at an all-time excessive.

The potential for vitality dividends to be paid and elevated has by no means been larger, largely as a result of the sector is taken into account uninvestable by so many — a outstanding paradox.

Slightly than single out particular person shares, it is likely to be extra useful for traders if I can no less than add some curiosity to their views of the group, distant from the consensus conviction.

Start with easy provide and demand. Crowds of votes, rules and protests to place an finish to fossil fuels have resulted within the fewest oil

CL.1,

and pure fuel

NG00,

discoveries final 12 months, since 1946. But the variety of world households has greater than tripled since then, demanding extra merchandise, that in flip requires extra petroleum to supply.

Between now and 2050, the United Nations aim of web zero carbon emissions, the demand for conventional vitality won’t solely assist dividends with extra free money movement however can enhance these dividends considerably going ahead.

The largest shock is likely to be a particular dividend for the local weather from probably the most unlikely sources.

Stakeholder math and mindset

The silliest notion of ESG traders protesting the possession of vitality shares by massive establishments was that forcing them to promote would restrict capital wanted to function.

Oil & fuel corporations haven’t any downside discovering cash. Previously, they’ve been so reckless in issuing shares and debt fueled by greed from chasing increased costs that they will go bankrupt all on their very own simply high-quality. Speculative traders poured cash into shale initiatives that by no means produced money movement and destroyed capital. The shale growth was an ideal lesson in geology and horrible math.

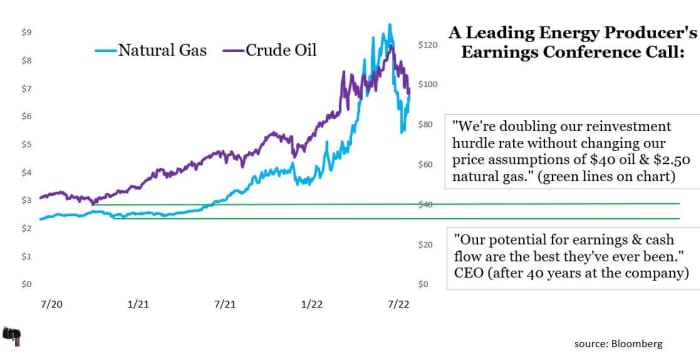

Specializing in a dividend requires self-discipline and extra conservative math. A couple of of the highest-quality vitality producers have begun to formally align their pursuits with stakeholders, displaying the maths they’re basing dividend projections on and utilizing commodity-price assumptions which are something however grasping.

Learn: Exxon hits record profit and Chevron’s triples amid high energy prices, sending stocks soaring

Traders are overlooking this monumental shift in mindset that has occurred because the final time oil and fuel costs have been this excessive.

Right here’s an instance from one in every of many corporations which have realized from boom-and-bust cycles to make use of extra conservative math. The inexperienced traces are oil and fuel value assumptions used to forecast their free money movement for dividends to be paid (one-half and one-third of present oil and fuel costs as of July 2022).

Not like earlier cycles, some vitality producers’ stability sheets are actually pristine; their web long-term debt has been diminished or eradicated. Pair that with rising their very own inside funding hurdle charges earlier than contemplating new initiatives, they usually’ve made the maths a lot more durable on themselves. Stakeholders are straight benefiting.

The very best operators I examine have realized arduous classes. However, as a portfolio supervisor I don’t take their phrase for it, I simply stick with the maths, which leaves no room for opinions.

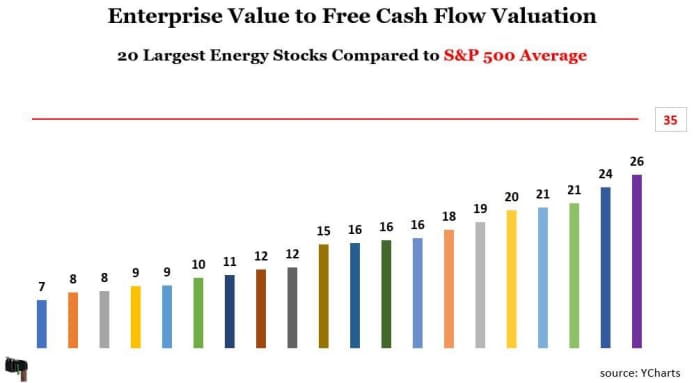

Free money movement is gushing, which assist extra dividends and fewer hypothesis. Even higher, they are often acquired at low cost costs in comparison with the general market because of pressured promoting strain. This chart reveals the present enterprise worth divided by trailing 12 months of free money movement. Every of the most important vitality corporations is significantly under the common of all sectors throughout the S&P 500, which is 35.

The upside of uncrowded truths

Vitality dividends are rising on account of our lowering capability to have trustworthy dialogues on this nation. Our democracy has chosen to make it troublesome or inconceivable for vitality corporations to develop their operations. So they’re doing what they will with free money movement: paying down debt, shopping for again shares and rising their dividends.

The crowds have made it ever more durable on vitality corporations to move oil and fuel and even more durable to refine it. These gigantic items of vitality’s puzzle extra straight impression American family’s day by day bills than the worth of a barrel of oil. To securely and affordably transfer vitality by means of pipelines requires a rising infrastructure that’s now near inconceivable to construct or develop.

A pipeline challenge with probably the most potential so as to add capability was lastly deserted in 2021, after being proposed in 2008, and totally backed by long-term contracts from producers in Canada. As a substitute, oil sands are loaded on railcars and far much less effectively hauled into the U.S. with larger dangers to the surroundings than pipelines.

I requested my good buddy Hinds Howard, a number one skilled of vitality pipelines, about every other latest developments which have an opportunity. He pointed to a different challenge that may battle to ever get completed after three years of allowing. The unique value estimates have virtually doubled simply from authorized work round further regulatory delays.

Vitality’s refining capability is even tighter. Slightly than simply face years of no progress and regulatory delays, refiners have been getting eradicated. Within the final three years alone, 4 refineries have been shut down and two partially closed. Two extra are scheduled to be closed. Six have been transformed to renewable diesel. That may be a web discount of greater than 1 million barrels a day.

As we speak there are 129 refineries, in 1982 there have been 250.

Then we’re shocked when rising demand for restricted provides end in increased costs? The traditionally distinctive alternative for traders is the irony of crowds of voters and protesters wanting to finish using fossil fuels, ended up making vitality dividends from the best high quality surviving operators safer than they’ve ever been.

Learn: What would it take for U.S. oil companies to ramp up production? A lot.

Probably the most stunning dividend

Up till now, I’ve relied on pure math, which I like as a result of it leaves no room for any opinion, together with my very own. Right here’s my solely guess, primarily based on the cleanest-burning motivation of capitalism to reward downside solvers: who higher to guide us to cleaner vitality than those that know precisely the place it’s dirtiest?

I lately visited with an vitality firm CFO, and he was most excited a few closed-loop fuel recapture challenge to scale back flaring fuel. The corporate developed this first-of-its-kind expertise to assist remedy an issue it created, and it has been significantly extra profitable than anticipated.

The brand new acknowledged aim is “zero” routine flaring by 2025 and the corporate has greater than doubled its local weather expertise funds prior to now three years to assist obtain that and check out extra initiatives.

Conventional vitality was already getting cleaner and extra environment friendly. The variety of carbon emission kilograms for each $1 of U.S. GDP has been greater than reduce in half since 1990. That’s not an answer, however it’s the proper path and the widespread curiosity of stakeholders of this planet.

Innovation is extra environment friendly than regulation. Vitality corporations within the U.S. have already got the very best local weather expertise on the planet, and it’s not even shut, they usually can nonetheless enhance all of it considerably. We must always lean into our benefits right here. Conventional vitality corporations play an enormous function in a extra sustainable future and pays elevated dividends to get there.

Ryan Krueger is CEO of Freedom Day Options, a cash supervisor primarily based in Houston, and the CIO of the agency’s Dividend Development Technique. Comply with him on Twitter @RyanKruegerROI.

Extra from MarketWatch

OPINION: It’s time to buy the selloff in energy stocks, starting with these 4 names

Oil prices have jumped. Yet these three energy ETFs remain a relative bargain. Can you cash in?

If you support green energy, you should buy utilities and oil stocks — here’s why

[ad_2]

Source link