[ad_1]

Nvidia Corp.’s data-center sales are expected to edge out its gaming sales in fiscal first-quarter results, as demand from server farms remains high and gaming interest has subsided from rabid levels earlier in the COVID-19 pandemic.

Nvidia

NVDA,

-2.51%

is scheduled to report financial results after the closing bell on Wednesday. Analysts surveyed by FactSet expect Nvidia’s data-center sales to come in at $3.58 billion, a 75% gain from the year-ago quarter, in what’s expected to be only the second time in the company’s history that data-center sales top gaming sales.

Analysts expect gaming sales of $3.46 billion. Last quarter, Colette Kress, Nvidia’s chief financial officer, forecast accelerated data-center growth into the first quarter, following a fourth quarter where data-center sales surged 71% year-over year to a record $3.26 billion.

Read: Why semiconductor stocks are ‘almost uninvestable’ despite record earnings amid a global shortage

So far, earnings season has shown strong gains for server chips. Intel Corp.

INTC,

-0.86%

doubled down on its full-year outlook as data-center revenue improved 22% to $6 billion, and Advanced Micro Devices Inc.

AMD,

-3.28%

posted its first $5 billion-plus quarter and guided for its first $6 billion-plus period.

Data center makes up a “low 20s-percent” of AMD’s enterprise, embedded and semi-custom chips unit — which includes data-center and gaming-console revenue. It surged 88% to $2.5 billion from a year ago. Sales will become more transparent as the company will finally start breaking out data-center sales in its own segment.

While AMD and Nvidia fight for shares in server CPUs, Nvidia dominates in its role as an accelerant for data centers. Jefferies analyst Mark Lipacis, who has a buy rating and a $370 price target on Nvidia, says the chip maker “dominates Dedicated Accelerator instances with approximately 80% share” of data-center sales.

Following results from Intel, AMD and others, Evercore analyst C.J. Muse, who has an overweight rating and a $300 price target on Nvidia, said that data-center products are facing “robust demand trends which are expected to drive very strong growth over the next few quarters.” Demand, however, has hardly seemed to be a problem; rather, supply difficulties and ever-increasing roadblocks are the issues.

Investors will be looking for any problems similar to Cisco Systems Inc.

CSCO,

+2.92%,

which reported its earnings this past week. Cisco — which has an April-ending quarter like Nvidia — noted that it was broadsided after Chinese authorities locked down Shanghai starting on March 27, and threw a monkey wrench into Cisco’s ability to get components. As a result, Cisco issued a poor outlook and shares saw their worst day in more than a decade.

Earnings: Of 39 analysts surveyed by FactSet, Nvidia on average is expected to post adjusted earnings of $1.30 a share, up from 92 cents a share reported a year ago and the $1.19 a share expected at the beginning of the quarter. All figures are adjusted for last year’s 4-for-1 stock split.

Revenue: Wall Street expects revenue of $8.12 billion from Nvidia, according to 36 analysts polled by FactSet. That’s up from the $5.66 billion Nvidia reported in the year-ago quarter and $7.28 billion forecast at the beginning of the quarter. In its last earnings report, Nvidia forecast $7.94 billion to $8.26 billion.

Stock movement: Over Nvidia’s first, or April-ending, quarter, shares dropped 25%, while the PHLX Semiconductor Index

SOX,

-0.27%

fell 17% over that period. Meanwhile, the S&P 500 index

SPX,

+0.01%

shed 8.5%, while the Nasdaq Composite Index

COMP,

-0.30%

dropped 13%. On Nov. 29, Nvidia’s stock closed at an all-time high of $333.76, and has since dropped 50%.

Nvidia has topped analyst estimates for earnings consistently over the past five years and has beaten Street revenue estimates for 12 consecutive quarters. Shares did fall 7.6% the day after last quarter’s report, despite the earnings beat. Generally, the stock’s movement has been mixed amid the string of beats.

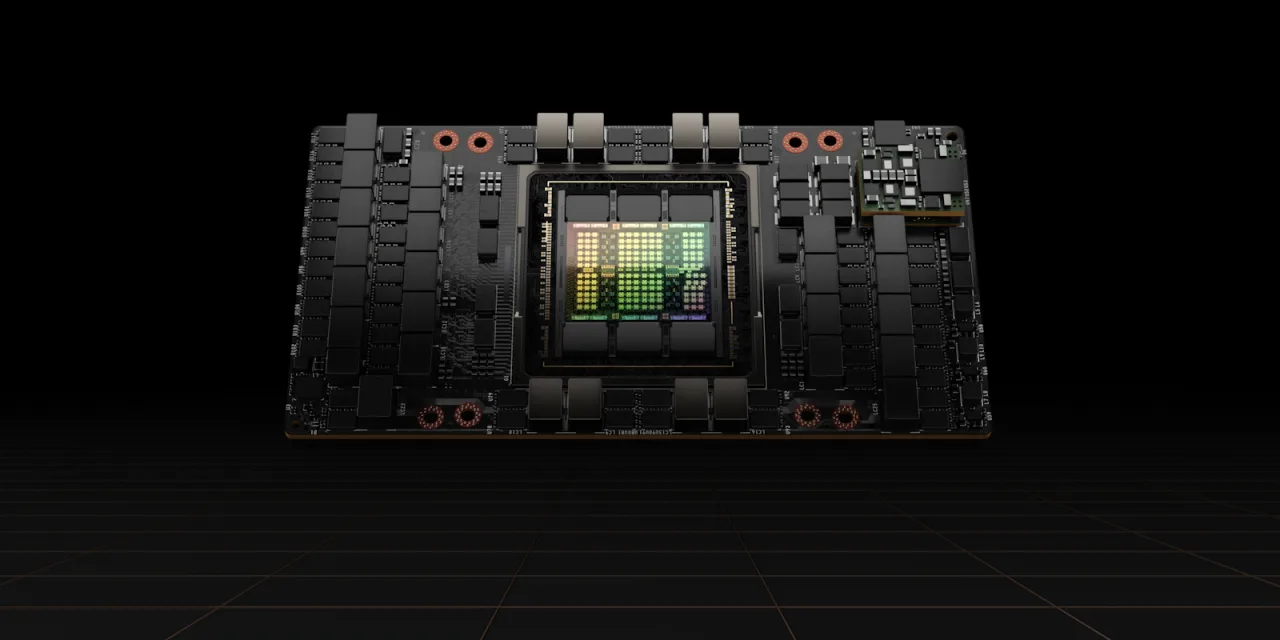

Oppenheimer analyst Rick Schafer, who has an outperform rating and a $300 price target, said Nvidia will likely solidify its data-center leadership as its new H100 chip ramps up in the third quarter.

“Demand continues to outpace supply, though constraints should ease into 2H,” Shafer said. “Nextgen Ada Lovelace performance gaming GPU is expected in 3Q. Our long-term thesis remains intact as NVDA‘s core leading gaming and AI accelerator franchises remain positioned for outsize structural growth.”

Wedbush analyst Matt Bryson, who has a neutral rating and a $190 price target, said any downside for Nvidia “is necessarily predominantly tied to gaming revenues.”

“For gaming, falling secondary market prices and improved availability in retail are among the signals that GPU demand is finally slowing,” Bryson said. “While such a result makes sense, particularly with the velocity of Ethereum hashing adds declining, the specific impact to Nvidia is hard to quantify given numerous variables.”

Read: Nvidia seeks to lead gold rush into the metaverse with new AI tools

Susquehanna Financial analyst Christopher Rolland, who has a positive rating and a $320 price target, agreed in a Wednesday note that “any significant beat and raise may be capped by gaming headwinds.”

“For gaming, we note the retail premiums above MSRP for Nvidia cards has declined precipitously from a high of +130% in mid-2021 to +78% in January and just 23% today,” Rolland said. “Coincident with these price declines, we have also witnessed a significant restocking, with all major card families now available at retailers.”

Of the 45 analysts who cover Nvidia, 37 have buy ratings, seven have hold ratings, and one has a sell rating, with the stock trading at 48% of the average price target of $319.95.

Hey there! Ready to embark on a historical journey with Air India? Whether you're a…

In 2017, altcoins were seen as experimental side projects to Bitcoin. By 2021, they became…

Shopping centers in Las Vegas have a unique opportunity to stand out by offering not…

Levitra, a widely recognized medication for treating erectile dysfunction (ED), has proven to be a…

Have you ever looked down at your carpet and wondered if there’s a budget-friendly way…

Counter-Strike 2 (CS2) has elevated the thrill of case openings, captivating both seasoned CS:GO veterans…