M&A glides Atlas to high industrial gainer, whereas earnings play spoilsport for losers

[ad_1]

sharply_done/E+ by way of Getty Photos

Whereas acquisition information drove the highest two industrial shares on this week’s gainers, it was earnings that had a say in impacting the shedding shares, aside from Kanzhun which discovered itself because the worst performer within the listing.

For the week ending Aug. 5, seven out of the 11 sectors within the S&P 500 had been within the inexperienced. The S&P 500 posted its strongest month-to-month efficiency since November 2020, rising +9.11% for July. For the primary week of August, The SPDR S&P 500 Belief ETF (SPY) was (+0.36%), making positive aspects for 3 weeks in a row now. Nevertheless, YTD, the ETF is -12.95%. The Industrial Choose Sector SPDR (XLI) additionally rose for the third week straight and closed (+0.50%). However, YTD, XLI is within the purple -9.16%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +18% every this week. Nevertheless, YTD, solely two out of those 5 shares are within the inexperienced.

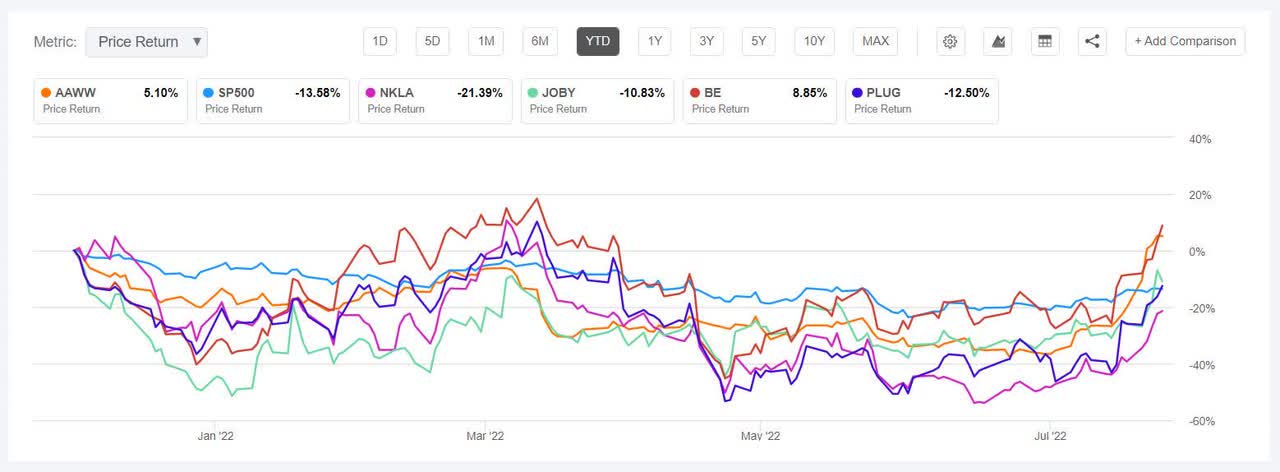

Atlas Air Worldwide (NASDAQ:AAWW) +31.62%. The airfreight operator gained on reports that an investor group led by funds managed by associates of Apollo World Administration, with associates of J.F. Lehman and Hill Metropolis Capital had been going to accumulate the corporate for $102.50 per share in money, at an enterprise worth of ~$5.2B. The deal was formally announced on Aug. 4, the identical day the corporate additionally reported its Q2 outcomes.

The SA Quant Score on the shares is Hold, which takes under consideration elements similar to valuation and profitability, amongst others issues. The ranking is in distinction to the common Wall Avenue Analysts’ Score of Buy, whereby 1 analyst every offers the inventory a Robust Purchase, and Purchase ranking, respectively whereas 4 tag it as Maintain. YTD, the inventory is up +5.88%, one of many solely two shares, amongst this week’s high 5 gainers, which within the inexperienced for this era.

Nikola (NKLA) +29.42%. The inventory gained all through the week, beginning Aug. 1 (+7.88%) after asserting that it was acquiring Romeo Energy in an all-stock deal. The inventory additionally rallied on Nikola’s stockholders approving the issuance of extra shares. The inventory continued its momentum after Q2 results beat estimates and the corporate stated that it was on monitor to ship 300-500 manufacturing Tre BEV vehicles in 2022.

Nevertheless YTD, the inventory has shed -18.44%, and it was among the many worst 5 industrial stocks (on this section) in H1 (-51.82%). The SA Quant Score on the inventory is Maintain, with Profitability having an element grade of F and Development with A+ issue grade. The typical Wall Avenue Analysts’ Score concurs, with a Hold ranking of its personal, whereby 6 out of seven analysts tag it as Hold.

The chart beneath exhibits YTD price-return efficiency of the highest 5 gainers and SP500:

Joby Aviation (JOBY) +20.40%. The Santa Cruz, Calif.-based air taxi firm’s inventory gained probably the most on Aug. 4 (+12.99%), making it to the highest 5 gainers’ listing, a significantly better efficiency in comparison with nearly two months in the past when it was among the many worst 5 decliners. The SA Quant Score on the inventory is Sell, with Profitability having an element grade of D- and Valuation with an F issue grade. Nevertheless, the common Wall Avenue Analysts’ Score differs and provides the inventory a Buy ranking, with an Common Worth Goal of $8.4.

Bloom Vitality (BE) +19.13. The inventory made it to the highest 5 gainers listing for the second week in a row. The San Jose, Calif.-based firm, which offers energy technology platform, gained amongst photo voltaic and inexperienced power shares after the U.S. Senate local weather and energy plan seemed set for passage. The typical Wall Avenue Analysts’ Score on BE is Buy, contradicting an SA Quant Score of Hold. YTD, BE has risen +9.90%, the one different inventory moreover AAWW amongst this week’s high 5 gainers which is within the inexperienced.

One other clear power associated inventory, Plug Energy (PLUG) +18.04% additionally gained on the local weather invoice information however the firm’ shares rose probably the most earlier within the week (Aug. 2 +9.37%). The week additionally noticed Plug and New Fortress Vitality signal an agreement to construct a 120 MW industrial-scale inexperienced hydrogen plant close to Beaumont, Texas. PLUG has been out and in of the top 5 gainers and losers prior to now one month. The SA Quant Score on the inventory is Hold, which is in distinction to the common Wall Avenue Analysts’ Score of Buy, whereby 14 out of 28 analysts give the inventory a Robust Purchase ranking. YTD, the share worth has fallen -10.77%.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -9% every. YTD, all these 5 shares are within the purple.

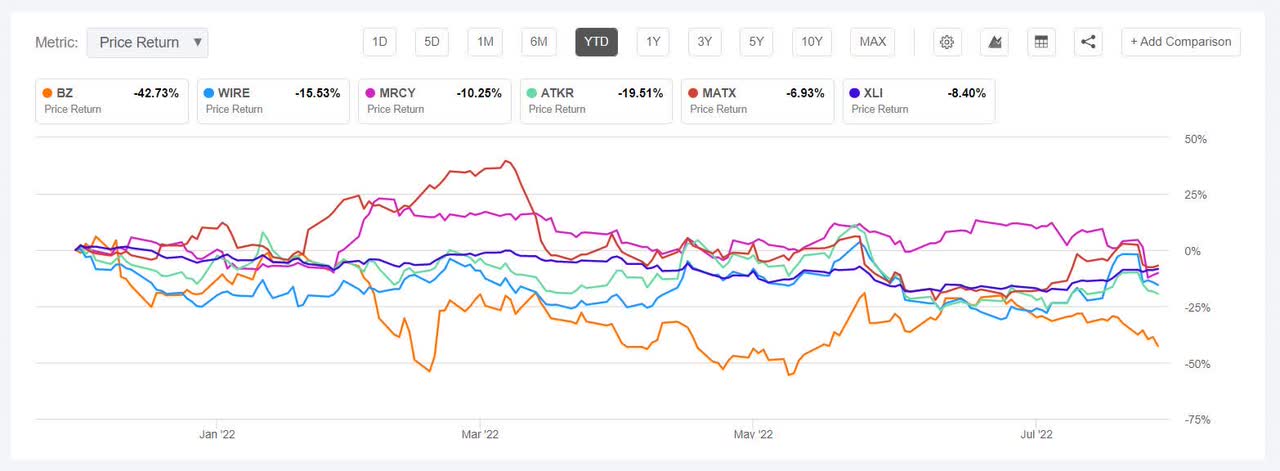

Kanzhun (NASDAQ:BZ) -15.19%. The Chinese language on-line recruitment platform’s shares declined probably the most on Aug. 1 (-7.57%).The inventory continued its volatility, and was again among the many decliners after three weeks. BZ gained properly in June (+30%) and w among the many high 5 (on this section). Nevertheless, the inventory was among the many worst 5 decliners within the first week of Might, having made to the top within the final week of April. Related trends had been seen in March. The SA Quant Score on the inventory is Hold, with Profitability having an element grade of B- whereas Valuation having an element grade of D. The typical Wall Avenue Analysts’ Score differs and tags BZ as Buy, whereby 7 out of 11 analysts give the inventory a Robust Purchase ranking. YTD, Kanzhun has misplaced -42.83%, probably the most amongst this week’s decliners.

Encore Wire (WIRE) -14%. The Texas-based firm’s inventory pared off gains it made final week following its Q2 earnings outcomes. The inventory declined probably the most on Aug. 2 (-12.62%). The SA Quant Score on the shares is Robust Purchase, with Development and Valuation each having an element grade of B+. The typical Wall Avenue Analysts’ Score concurs and in addition tags it as a Strong Buy. YTD, the inventory has declined -16.78%.

The chart beneath exhibits YTD price-return efficiency of the worst 5 decliners and XLI:

Mercury Methods (MRCY) -13.62%. The Andover, Mass.-based aero/protection merchandise maker noticed its inventory dip probably the most on Aug. 3 (-13.34%), the day after its FQ4 results missed analysts estimates. The inventory was among the many worst 5 decliners two weeks in the past as properly. YTD, MRCY has shed -7.43%. The typical Wall Avenue Analysts’ Score is Buy, which differs with the SA Quant Score of Hold on the inventory.

Atkore (ATKR) -10.46%. The inventory declined -5.88% on Aug. 2 regardless of the corporate’s Q3 results surpassing analysts estimates. The Harvey, Sick.-based electrical merchandise maker was again within the worst 5 decliners listing after over a month. The SA Quant Score on the inventory is Strong Buy, whereas the common Wall Avenue Analysts’ Score is Buy. YTD, Atkore has fallen -20.06%.

Matson (MATX) -9.47%. The Honolulu, Hawaii-based transport firm’s shares slumped -8.69% on Aug 2, after at Stifel downgraded the inventory regardless of robust earnings in Q2. The typical Wall Avenue Analysts’ Score is Buy, whereas the SA Quant Score is Hold. YTD, Matson has declined -7.82%.

Source link