Here are 2 stocks that Oppenheimer likes

[ad_1]

By now, we all know the litany of market woes and headwinds: inflation, which has been grabbing all the headlines; the Fed’s turn to rate hikes and monetary tightening in response to inflation; the continued list of interconnected issues, including supply chain tangles, the Russia-Ukraine war, high oil prices.

Recent news and market stats have only reinforced the short-term gloom. Q1 showed a GDP decline of 1.6%, and preliminary data shows a similar decline for Q2, which would put the US into a recession. But do the current clouded conditions mean that investors have to fully back away from the bulls?

Weighing in from Oppenheimer, chief investment strategist John Stoltzfus doesn’t back away from trying to square that circle. Acknowledging and analyzing today’s market environment, Stoltzfus confronts it head on, writing, “Even in the face of uncertainty and palpable risks of recession, our longer-term outlook for the U.S. economy and the stock market remains decidedly bullish. We believe U.S. economic fundamentals remain on solid footing. U.S. growth should remain well supported by consumer, investment and government spending.”

Taking Stoltzfus’ outlook and turning it into concrete recommendations, the pros at Oppenheimer are giving two stocks a thumbs up. In fact, the firm’s analysts see over 50% upside potential in store for each. We used TipRanks’ database to find out what the rest of the Street has to say.

Vertex Energy (VTNR)

First up is Vertex, a transitional energy company with a focus on the production and distribution of both conventional and alternative fuels. The company owns approximately 3.2 million barrels worth of storage capacity, as well as an oil refinery in Mobile, Alabama capable of producing 91,000 barrels per day of refined fuel. Vertex is a key supplier of base oils for the North American lubricant industry, and is one of the largest processors of used motor oil in the US market.

The Mobile refining facility is one of the keys to understanding Vertex Energy’s current position. The company purchased the refinery from Shell Oil, in a transaction that was completed in April of this year. Vertex paid $75 million in cash plus $25 million in other capital expenditures. Along with the refinery, Vertex received a hydrocarbon inventory worth $165 million, financed in a separate agreement. This acquisition is a major advance in Vertex’s refining capabilities, and puts the company in position to commence renewable diesel fuel production in 1Q23. The Mobile refinery maintained normal operations through the late winter and early spring, while the transfer of ownership was progressing.

Also in the first quarter of this year, Vertex saw its top line revenue grow year-over-year, from $25.05 million to $40.22 million, a gain of 60%. Earnings, however, slipped, from a 1-cent gain per diluted share in the year-ago quarter to an 8-cent loss in the 1Q22 report. Despite the loss, Vertex was able to increase its cash holdings year-over-year by approximately a factor of 10, from $12.52 million to $124.54 million.

In one other highly positive announcement made in recent weeks, Vertex in June entered the Russell 3000 stock index.

Noah Kaye, a 5-star analyst with Oppenheimer, sees everything going right for Vertex at this moment, and writes of the company: “Vertex is currently experiencing a ‘blue-sky scenario’ on the Mobile acquisition. The company is undertaking a comparatively low-cost renewable diesel capital project at Mobile while intending to continue producing primarily conventional fuels. While attentive to execution risk and spread compression, and seeing questions around the platform’s strategic future, we anticipate a step-change in profitability to enable flexibility for Vertex’s future growth.”

Viewing this stock as an engine for growth going forward, Kaye rates it an Outperform (i.e. Buy), and sets a price target of $18 to suggest a one-year upside of ~52%. (To watch Kaye’s track record, click here)

Overall, it’s clear from the unanimous Strong Buy consensus that Wall Street likes what it sees in VTNR. The stock is currently trading for $11.87 and its $22.50 average target implies ~90% upside potential from that level. (See VTNR stock forecast on TipRanks)

Lumos Pharma (LUMO)

We’ll shift our focus now to the biopharma sector, where Lumos is working on new therapies for rare diseases, through safer and more effective orally dosed growth hormone stimulation treatments. The company’s lone drug candidate, LUM-201, is under investigation in clinical trials as a treatment for pediatric growth hormone deficiency (PGHD), a serious condition that can lead to complications in adult life. Current treatments for PGHD involve frequent injections over a span of years; Lumos’s orally dosed option, if it receives approval from the FDA, will represent a new alternative for patients.

Currently, LUM-201 is undergoing several human clinical trials, evaluating its potential. The leading trial, the Phase 2 OraGrowtH210 study, has reportedly reached the 50% randomization milestone. Interim analysis of this trial is expected before the end of this year, with primary outcome data expected for release in 2H23. The other advanced trials, the PK/PD trial, or OraGrowtH212, is expected to show interim data analysis later this year.

Two other trials are at earlier stages. OraGrowth211 is a proposed long-term extension of this trial series, and the OraGrowtH213 trial is a switch study which has been initiated to evaluate moving LUM-201 patients from the rhGH arm of the OraGrowtH210 study.

Altogether, the data from these studies convinced the FDA in May to lift a partial clinical hold which had been imposed on Lumos’s trial program. The hold was put in place last summer, and restricted the clinical trials to a 12-month duration. With it lifted, Lumos will be able to conducted more extended studies, and to initiate new, longer-term clinical trials of LUM-201. The company has plans to conduct the OraGrowtH210 study over a term of 24 months, and to extend duration of the OraGrowtH212 study.

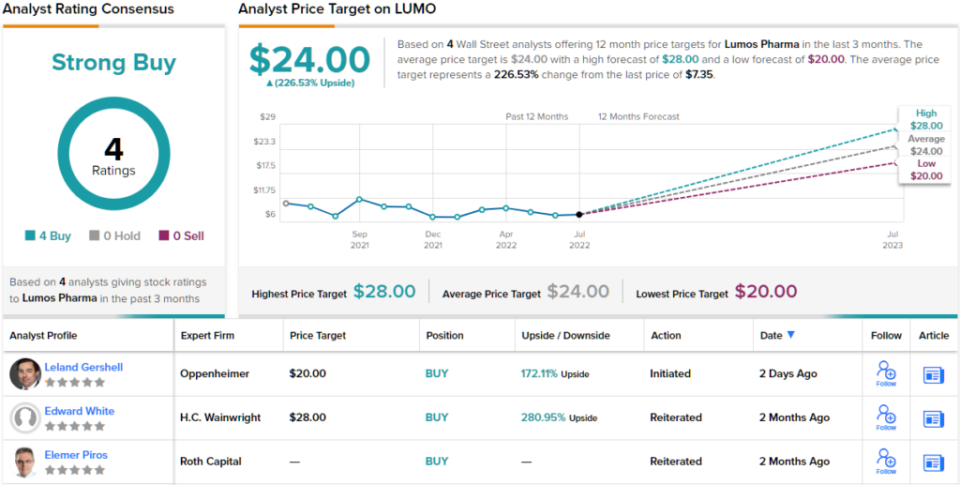

All in all, this company’s position, with a solid drug candidate prospect in a field with a high medical need, prompted Oppenheimer’s Leland Gershell to initiate his coverage of the stock with an Outperform (i.e. Buy) rating.

Backing his stance, Gershell wrote, “LUMO is positioned to transform the treatment landscape for disorders stemming from growth hormone deficiency (GHD) through the potential introduction of a daily oral medication… We look forward to a Phase 2 interim analysis as well as PK/PD data as key catalysts toward year-end, for which resources provide ample runway. With shares trading at ~cash levels, we recommend investors build a position.”

Looking forward, Gershell sets a $20 price target on LUMO shares, implying an upside of 172% on the one-year time frame. (To watch Gershell’s track record, click here)

The unanimous Strong Buy consensus rating on this biopharma stock is based on 4 recent positive analyst reviews. LUMO is trading for $7.35 and its $24 average price target indicates room for a robust 226% gain from current levels. (See Lumos stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link