Have we reached peak metal watch?

[ad_1]

“When you take a look at the Nautilus, it’s a really, very comfortable bracelet, a comfortable case. It’s discreet, a discreet, sport-elegant watch. What just isn’t discreet is the quantity of individuals keen to personal one. That’s a special matter.”

As issues go, that is about as high-class because it will get: Thierry Stern, president of Patek Philippe, finds himself within the place of creating the world’s most fascinating sports activities watch. The Nautilus is the built-in case and bracelet watch designed by Gérald Genta and launched by Thierry’s father Philippe in 1976. For many of its life, it has fulfilled its operate because the look ahead to the Patek Philippe buyer who didn’t need to put on his grande complication perpetual calendar, chronograph or his minute repeater whereas swimming.

However by the point that this idiosyncratic-looking watch reached its fortieth birthday it was turning into a scorching watch. That was in 2016, and since then the temperature simply saved rising, till final yr when Thierry Stern determined to retire the metal Ref 5711. A closing collection with a delicate inexperienced dial was introduced, and on the finish of the yr a run of 5711s with a Tiffany-blue dial was made for the eponymous retailer.

The 5711 was in peril of turning into the tail that wagged the canine. Patek Philippe is a watchmaker lively in all sectors, from the best problems to the only costume watches, but the mania for the Nautilus, with ready lists stretching years into the future, was turning into a distraction.

The announcement, nonetheless, despatched costs rocketing on the secondary market. As just lately as June, Phillips bought a daily manufacturing 5711 for $170,000 (about 5 instances what the official retail had been).

Audemars Piguet Royal Oak

Rolex Oystersteel Daytona

The scenario is much from distinctive to Patek. Secondary market costs of the Genta-designed Audemars Piguet Royal Oak, 50 years previous this yr (Christie’s bought a 15202ST for simply over HK$1mn — about £114,000 — in April), and nearly any metal Rolexes, have risen sharply up to now couple of years. As a substitute of promoting, retail workers now discover themselves within the enterprise of managing expectations. “We’ve got needed to make investments vital time in coaching our retailer groups to handle pissed off shoppers,” says Brian Duffy, CEO of Watches of Switzerland. In the meantime, conspiracy theories grew to become so lurid that Rolex issued a public assertion concerning the scarcity. “The shortage of our merchandise just isn’t a method on our half. Our present manufacturing can not meet the prevailing demand in an exhaustive manner, at the least not with out decreasing the standard of our watches — one thing we refuse to do as the standard of our merchandise mustn’t ever be compromised.”

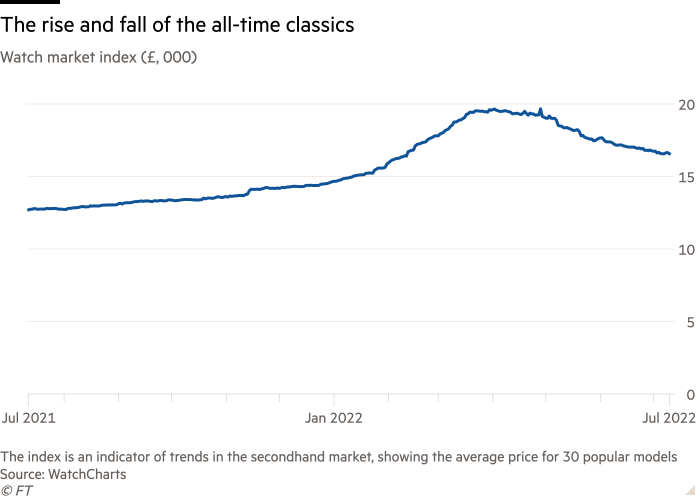

However in latest months costs have cooled within the secondary market, as Danny Pizzigoni, founding father of The Watch Membership, observes. “I imagine metal sports activities watches are nonetheless the cornerstone of any assortment, however we’ve had unprecedented development, particularly up to now two to a few years, that has pushed ‘metal sports activities’ to a special class, which made us just a little uneasy. There was a much-needed correction, and gross sales aren’t what they had been six to 12 months in the past.” He makes use of the instance of a Rolex chronograph: “Within the spring a model new ‘Panda’ 116500 metal Cosmograph Daytona hit £45,000 when it was put up on the secondary market; some vloggers speculated it might attain £100,000. However as we speak it sells for £35k to 37k — that’s 20 per cent down, however nonetheless 200 per cent above RRP, and nonetheless over 20 per cent above what we had been asking for a similar watch two years in the past. These über-collectable metal watches have had a blip, as a result of they went up too quick, and it wasn’t sustainable.”

This value correction has shone gentle on the emergence of the up to date and trendy metal sports activities watch as a discrete sector of watch accumulating, one with explicit enchantment for youthful collectors. “For younger collectors the preliminary attraction of metal sports activities watches is to have the ability to buy them at comparatively low retail costs,” says collector Shary Rahman. “Supplied, in fact, they are often discovered at retail, which has turn into more and more tough if not unimaginable.” Wearability, particularly as dressing turns into more and more informal, and sturdiness when it comes to robustness and water resistance additional add to the enchantment, whereas their on-line recognisability has enhanced their powers of status-conferral. “Right this moment’s technology thrives on on the spot gratification, in some ways fuelled by the unprecedented affect of social media,” says Rahman. “Accumulating basically is now not restricted to being a interest however a method of having the ability to set up oneself as an authority on all issues collectable and enhancing one’s credibility within the social media-filled metaverse!”

“The demographic is completely different, it’s a youthful, social media-aspirational market influenced by seeing Ed Sheeran carrying a Nautilus, or Jay-Z entrance row in his skeleton Royal Oak,” concurs Pizzigoni.

Amongst much less skilled collectors, the flexibility to establish a watch from a social media put up is usually confused with actual information and understanding. “There may be no need for experience or analysis — not like classic watches, which require persistence and analysis to seek out the fitting examples,” says Silas Walton, founding father of specialist watch gross sales platform A Collected Man. “From an funding perspective, ‘blue-chip’ classic Patek Philippe doesn’t supply the identical perceived monetary return, within the brief time period. Metal sports activities watches might be in comparison with bullish expertise shares, whereas ‘blue-chip’ classic Patek Philippe might signify extra mature, longer-term, sound investments.”

There was definitely hypothesis and risk-taking. Anecdotally I’ve heard from one public sale home specialist that he had been receiving calls from teams of three or 4 individuals wanting to purchase a Nautilus utilizing bank cards, purely for funding; on condition that credit-card curiosity runs at round 20 per cent APR, that may imply expectations had been working terribly excessive.

In fact, this isn’t real watch-collecting. However whereas rash speculators who entered the commoditised metal sports activities market may take some losses, scarcer items, whether or not a classic complication, green-dial Nautilus or Paul Newman Daytona, are much less unstable. “We’re not witnessing the identical correction with the rarest items,” mentioned one vendor.

In the meantime, Brian Duffy actively welcomes a cooling of the secondary market. “Irrational value premiums are unhealthy and unhelpful for the real watch-lover and authorised retailer. Our ready lists are increasing. We’re including ROIs [registrations of interest] quicker than we’re supplying watches and there’s a higher unfold of gross sales throughout many manufacturers.”

He’s seeing that prospects deterred by secondary-market premiums and lengthy ready lists are discovering that there’s an rising selection of attention-grabbing metal sports activities fashions from different manufacturers: Chopard has skilled successful with its Alpine Eagle; Vacheron Constantin’s Abroad has been rediscovered; and Bulgari’s Octo Finissimo is a recent traditional. If these don’t enchantment, how concerning the Odysseus from A Lange & Söhne or Zenith’s Defy Skyline? The horizon is increasing.

Source link