Removed from Putin’s claims of resilience, Russian financial system is being hammered by sanctions and exodus of worldwide firms, Yale report finds

[ad_1]

Media studies trumpeting the resilience of the Russian financial system within the face of the worldwide response to its invasion of neighboring Ukraine are based mostly on misunderstandings that don’t mirror what’s occurring on the bottom, in keeping with a brand new paper from the Yale College of Administration.

The report, known as “Enterprise retreats and sanctions are crippling the Russian financial system,” discovered that removed from the “prosperity” touted by the Kremlin and Russian President Vladimir Putin, the sanctions — and the exodus of greater than 1,000 international firms –are having a catastrophic impact.

The report drew on non-public Russian language and unconventional knowledge sources together with excessive frequency shopper knowledge, cross-channel checks, releases from Russia’s worldwide commerce companions, and knowledge mining of complicated transport knowledge, in keeping with the authors, led by Professor Jeffery Sonnenfeld, senior affiliate dean for management research on the Yale College of Administration.

“From our evaluation, it turns into clear: enterprise retreats and sanctions are catastrophically crippling the Russian financial system. We deal with a variety of widespread misperceptions – and make clear what is definitely happening inside Russia,” stated the report.

See Now: Despite plenty of talk, many U.S. companies have still not fully exited Russia: Moral Rating Agency

Associated: Kremlin could seize Russian assets of U.S. companies, warns Moral Rating Agency

(For a fast abstract of the report, check out this TikTok video by Canadian Steve Boots, who presents political commentary on social media.)

The Yale crew has been monitoring the businesses which have exited Russia because the begin of the warfare — and those who haven’t — and has discovered that the leavers are being rewarded by the inventory market, whereas remainers are being punished.

See now: Companies that exited Russia after its invasion of Ukraine are being rewarded with outsize stock-market returns, Yale study finds — and those that stayed are not

Among the many report’s key findings are:

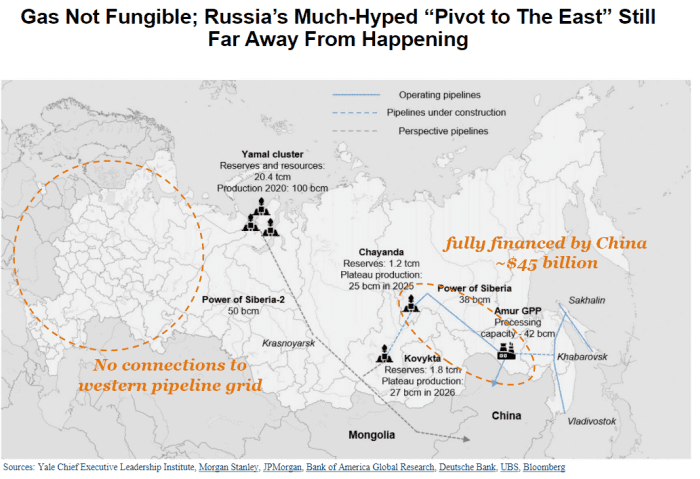

• Russia’s place as a commodities exporter “has irrevocably deteriorated,” because it has misplaced entry to its former essential markets and is dealing with challenges in pivoting to Asia with non-fungible exports akin to piped gasoline.

Supply: Yale College of Administration Report

• Russian imports have additionally principally collapsed and it’s struggling to safe essential inputs, elements and know-how from hesitant commerce companions, creating critical provide shortages.

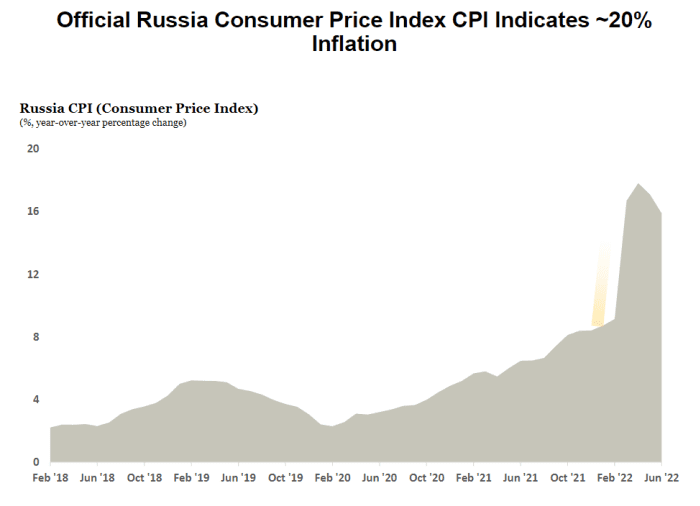

• Whereas Putin boasts of the nation’s self-sufficiency, home manufacturing has come to a standstill with no capability to interchange misplaced enterprise, merchandise and expertise. On the similar time, Russia is dealing with the identical hovering costs and shopper angst as seen in many of the world.

Supply: Yale College of Administration

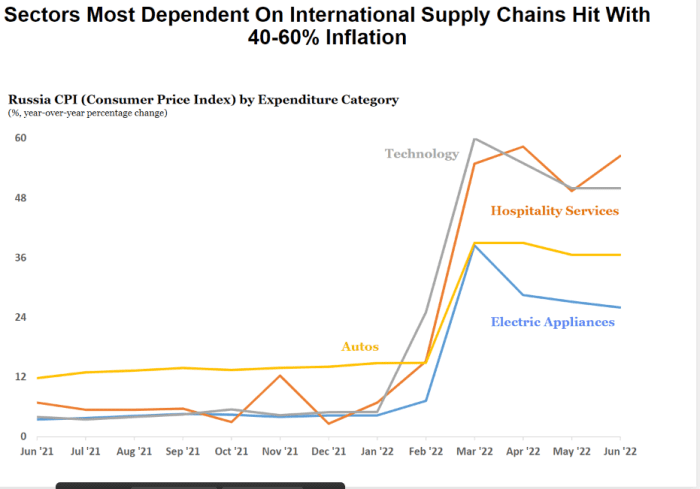

• The inflation image for sectors that rely on worldwide provide chains is much more grim at 40% to 60% and that’s impacting a swath of key industries. The report describes how some Russian producers are resorting to cannibalizing and recycling elements, and cites U.S. Commerce Secretary Gina Raimondo as saying Ukrainians are discovering Russian navy tools full of semiconductors which were faraway from dishwashers and fridges.

Supply: Yale College of Administration

• The retreat of so many companies has value the nation about 40% of its GDP, reversing almost three many years of overseas funding.

“Putin is resorting to patently unsustainable, dramatic fiscal and financial intervention to easy over these structural financial weaknesses, which has already despatched his authorities funds into deficit for the primary time in years and drained his overseas reserves even with excessive power costs – and Kremlin funds are in a lot, way more dire straits than conventionally understood,” the authors wrote.

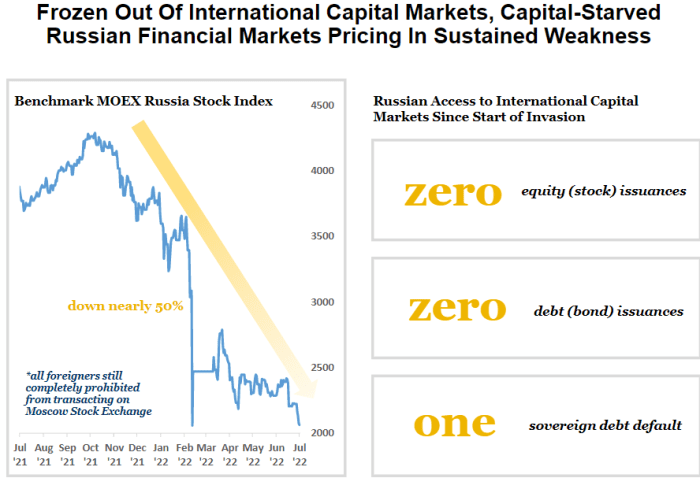

• Russia’s home monetary markets are the worst performing in the entire world this yr and that’s regardless of strict capital controls. On the similar time, it’s lower off from accessing international capital markets to revitalize its financial system.

Supply: Yale College of Administration

“Trying forward, there isn’t a path out of financial oblivion for Russia so long as the allied international locations stay unified in sustaining and rising sanctions strain towards Russia, and The Kyiv College of Economics and McFaul-Yermak Working Group have led the way in which in proposing extra sanctions measures,” stated the report.

“Defeatist headlines arguing that Russia’s financial system has bounced again are merely not factual – the information are that, by any metric and on any degree, the Russian financial system is reeling, and now isn’t the time to step on the brakes,” it concluded.

For the complete record of firms: Visit the Yale School of Management website

Source link