[ad_1]

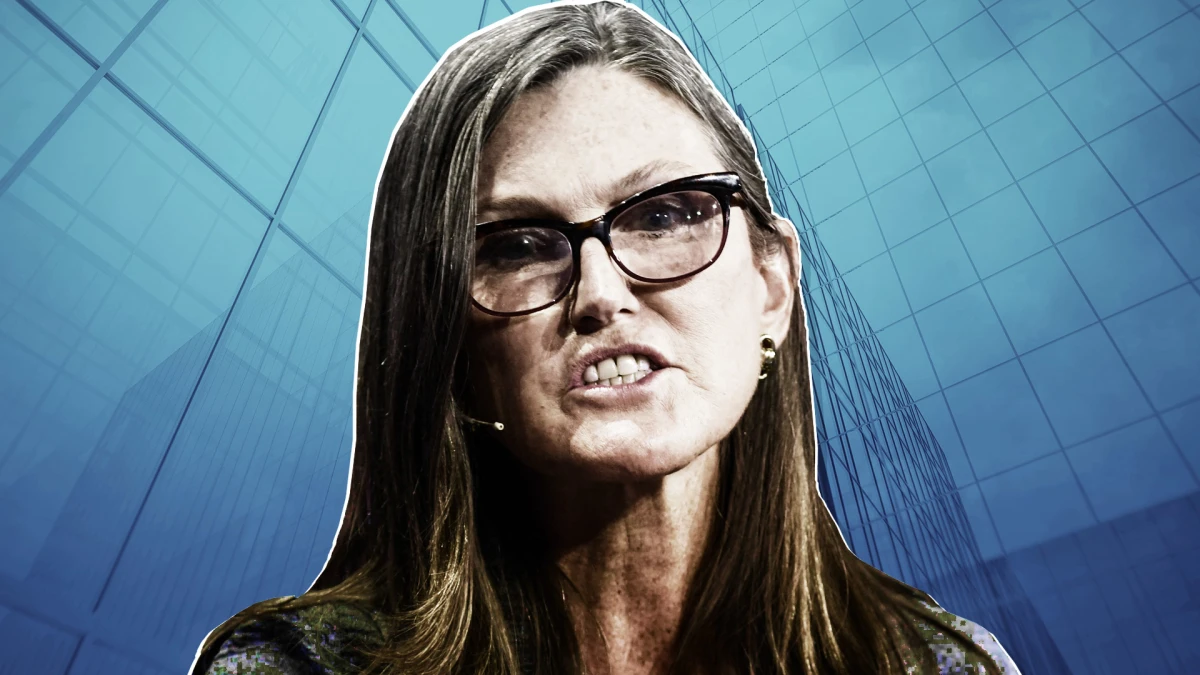

Famend investor Cathie Wooden, chief government of Ark Funding Administration, in Tuesday buying and selling reversed her stance on two main expertise corporations.

For months she had been shopping for Coinbase International (COIN) – Get Coinbase Global Inc Report, the nation’s largest cryptocurrency alternate, and promoting e-commerce platform Shopify (SHOP) – Get Shopify Inc. Class A Subordinate Report.

However Ark went within the reverse instructions on July 26. All valuations under are as of Tuesday’s shut.

Ark funds unloaded 1,418,324 shares of Coinbase, valued at $75.1 million. Tuesday reports said that the Securities and Exchange Commission was investigating whether or not the corporate illegally let clients commerce digital property that haven’t been registered as securities.

Coinbase shares dropped 21% on Tuesday and have slumped 79% 12 months up to now.

As for Shopify, Ark funds snagged 1,765,929 shares of the corporate, which hosts on-line shops for a lot of small companies. That inventory was valued at $55.7 million.

The corporate stated Tuesday that it was dropping about 1,000 staff, or 10% of its workforce, reversing a wager that its surge of enterprise earlier within the pandemic would proceed.

Shopify shares slumped 14% Tuesday and have sunk 77% up to now this 12 months.

Taking a look at different huge trades by Wooden, Ark Genomic Revolution ETF (ARKG) – Get ARK Genomic Revolution ETF Report bought 1,515,845 shares of 1Life Healthcare (ONEM) – Get 1Life Healthcare Inc. Report, a sequence of major healthcare clinics, valued at $25.4 million.

Scroll to Proceed

The inventory dipped 1.3% Tuesday. It has eased 4.7% 12 months up to now however has soared 78% since July 18.

Ark funds bought 2,764,807 shares of Ginkgo Bioworks (DNA) , a biotechnology firm, valued at $7.2 million. The inventory misplaced 6.1% Tuesday and has shed 69% up to now this 12 months.

Lastly, Ark Genomic Revolution snatched 347,683 shares of Guardant Well being (GH) – Get Guardant Health Inc. Report, a most cancers blood-test firm, valued at $16.8 million.

The inventory slipped 2.7% Tuesday and has descended 52% 12 months up to now.

Trailing the S&P 500

As Ark funds have tumbled in current months, Wooden has defended her technique by noting that she has a five-year funding horizon.

At Ark Innovation ETF (ARKK) – Get ARK Innovation ETF Report the five-year annualized return totaled 9.15% by way of July 26, trailing the S&P 500’s 11.59% return.

Ark Innovation has fallen 53% this 12 months as Wooden’s tech corporations have slumped. And it’s down 72% from its February 2021 peak. Raging inflation and hovering rates of interest have helped put the kibosh on tech shares.

Lots of Wooden’s traders seem little nervous about that underperformance. Ark Innovation loved a internet influx of $2 billion within the six months by way of July 25, according to VettaFi, an ETF analysis agency.

“I feel the inflows are taking place as a result of our purchasers have been diversifying away from broad-based benchmarks just like the Nasdaq 100,” Wooden has stated. “We’re devoted fully to disruptive innovation. Innovation solves issues.”

[ad_2]

Source link

In 2017, altcoins were seen as experimental side projects to Bitcoin. By 2021, they became…

Shopping centers in Las Vegas have a unique opportunity to stand out by offering not…

Levitra, a widely recognized medication for treating erectile dysfunction (ED), has proven to be a…

Have you ever looked down at your carpet and wondered if there’s a budget-friendly way…

Counter-Strike 2 (CS2) has elevated the thrill of case openings, captivating both seasoned CS:GO veterans…

Trying to sell a car online should be simple, but sometimes buyers lose interest fast.…