All eyes on Apple’s Q3 amid looming macro challenges (NASDAQ:AAPL)

[ad_1]

Nikada/iStock Unreleased by way of Getty Photos

Apple (NASDAQ:AAPL) is scheduled to announce Q3 earnings outcomes on Thursday, July twenty eighth, after market shut.

The tech large has seen a sequence of worth goal cuts in current days – together with from BofA, Morgan Stanley and Effectively Fargo – over macro financial challenges together with rising inflation, a surging greenback, provide chain constraints and COVID restrictions in China.

The consensus EPS Estimate is $1.15 and the consensus Income Estimate is $82.97B (+1.9% Y/Y).

Apple has additionally reportedly slowed down hiring plans as a result of issues a couple of doable slowdown within the U.S. economic system, becoming a member of different big-name tech corporations which have lately altered a number of the hiring plans.

SA contributor Bohdan Kucheriavyi lately referred to as out Apple’s “over-reliance on China”, suggesting that this places its manufacturing at fixed threat of disruption and can undermine its Q3 efficiency.

The agency posted Q2 outcomes that beat expectations, led by energy within the iPhone, however CFO Luca Maestri mentioned June income is prone to be impacted by supply constraints brought on by COVID, silicon shortages, with the worth of the constraints between $4 billion and $8 billion, “considerably bigger” than Apple noticed within the March quarter.

Apple’s Mac and companies companies are prone to see some weak spot, however iPhone gross sales are set to stay stable. In accordance with Canalys, the corporate gained market share in smartphones throughout Q2, at the same time as general smartphone gross sales slipped 9% year-over-year. The analysis agency listed sturdy iPhone 13 demand as a driver of this market share achieve.

Traders can anticipate cautious commentary from administration amid the a number of headwinds, together with indicators of a slowdown in smartphone demand forward of the launch of the iPhone 14 within the fall.

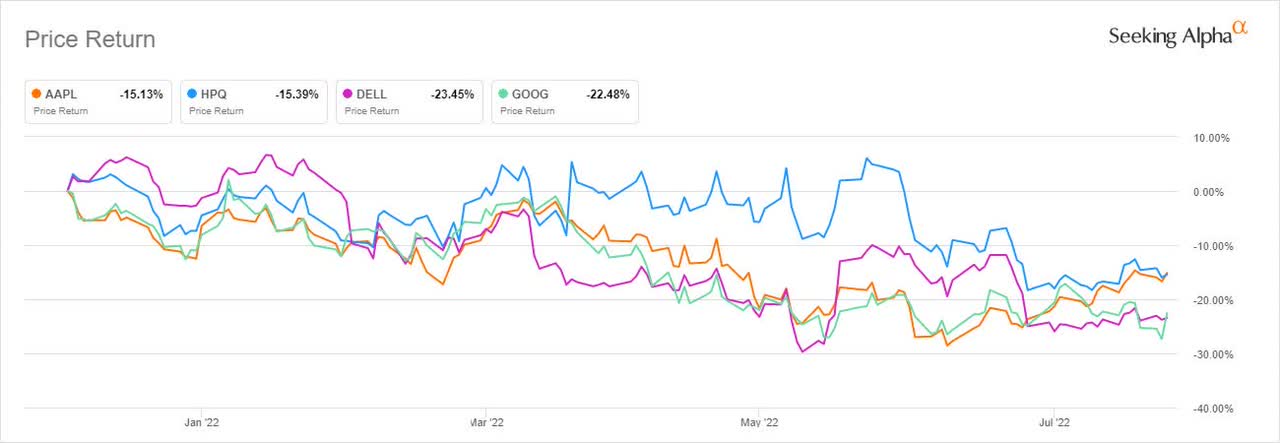

Considerations over its efficiency amid the worldwide inflation disaster has already harm its share worth, which has dropped simply over -15% within the yr so far. Nonetheless, shares have fared relatively better than peers:

A current SA contributor evaluation has warned that amid these a number of macro headwinds, Apple’s shares may plunge following the Q3 outcomes.

Apple’s Q3 efficiency may also be a bellwether for a way the broader tech sector will fare on the finish of this earnings season and the way the rest of the yr will search for the tech firm and the sector at giant.

During the last 1 yr, AAPL has beaten EPS estimates 100% of the time and has overwhelmed income estimates 100% of the time.

During the last 3 months, EPS estimates have seen 4 upward revisions and 24 downward. Income estimates have seen 5 upward revisions and 20 downward.

Source link