Alibaba Is Sold out on the Downside

[ad_1]

I read online Monday that half of the provinces in China are in some form of Covid lockdown so I see the news as half full rather than half empty. I see China at a bearish extreme and “uninvestable” as an opportunity for a trade to the upside.

Let’s check on the charts on one big name.

In this daily bar chart of Alibaba Group (BABA) , below, we can see that the shares have been in a long downtrend and trade below the declining 200-day line. Prices are also below the 50-day line but I can see a lot of testing of the line in the past few months. Prices have not made a new low since March and this tells me that the next test of the 50-day line is going to be successful and BABA should turn higher.

There was heavy trading volume in March and that may have been a “throw in the towel” moment for the stock The daily On-Balance-Volume (OBV) line has moved sideways since April. The 12-day price momentum study made a higher low from April to May for a small bullish divergence.

In the weekly Japanese candlestick chart of BABA, below, we can see some lower shadows below $80 telling us that traders are rejecting the lows. This is a positive sign for BABA.

The weekly OBV line is pointed down but stands above the early March low. The 12-week price momentum study shows higher lows from September and is a large bullish divergence when compared to the price action.

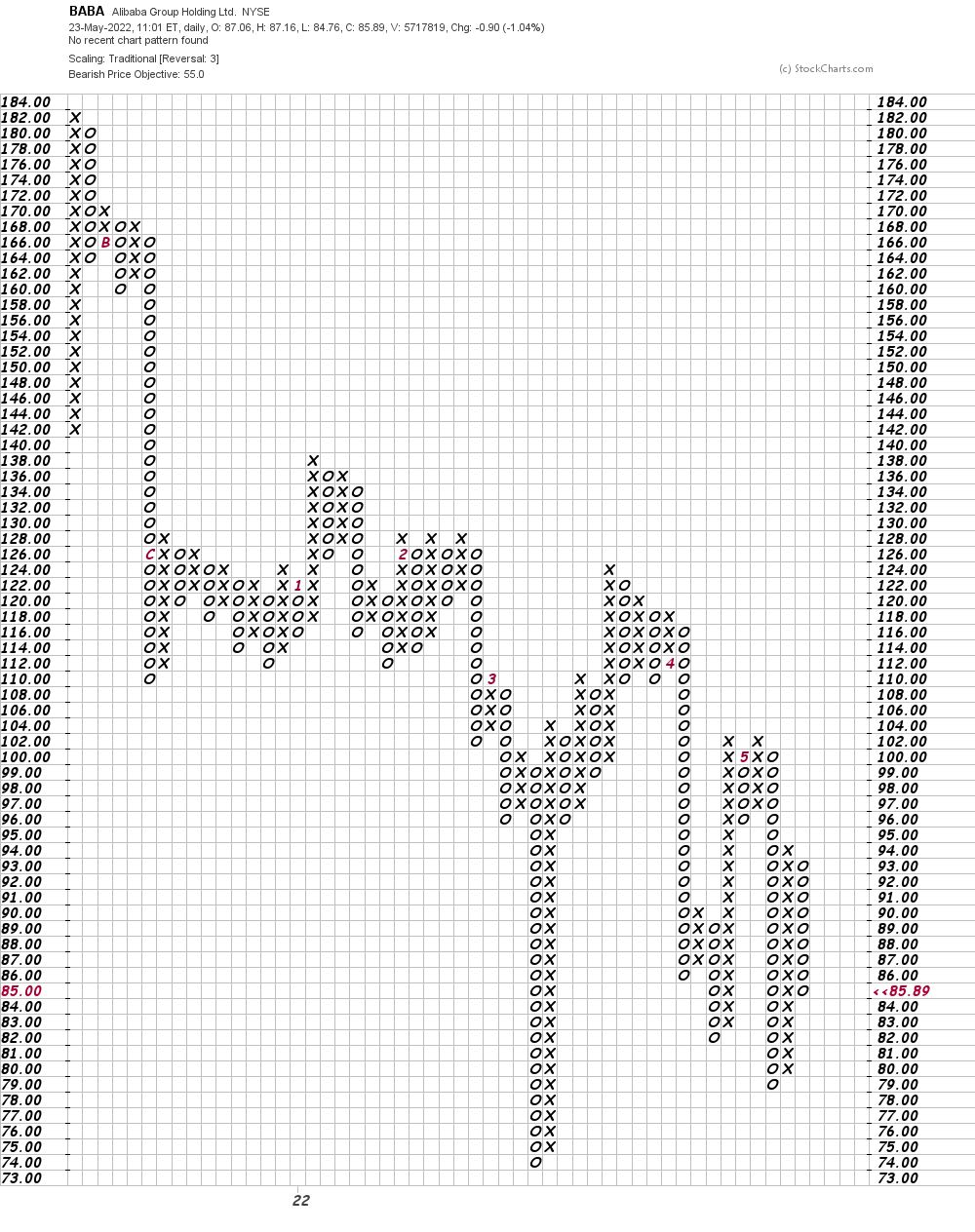

In this daily Point and Figure chart of BABA, below, we can see a downside price target of $55. A trade at $95 could improve the chart.

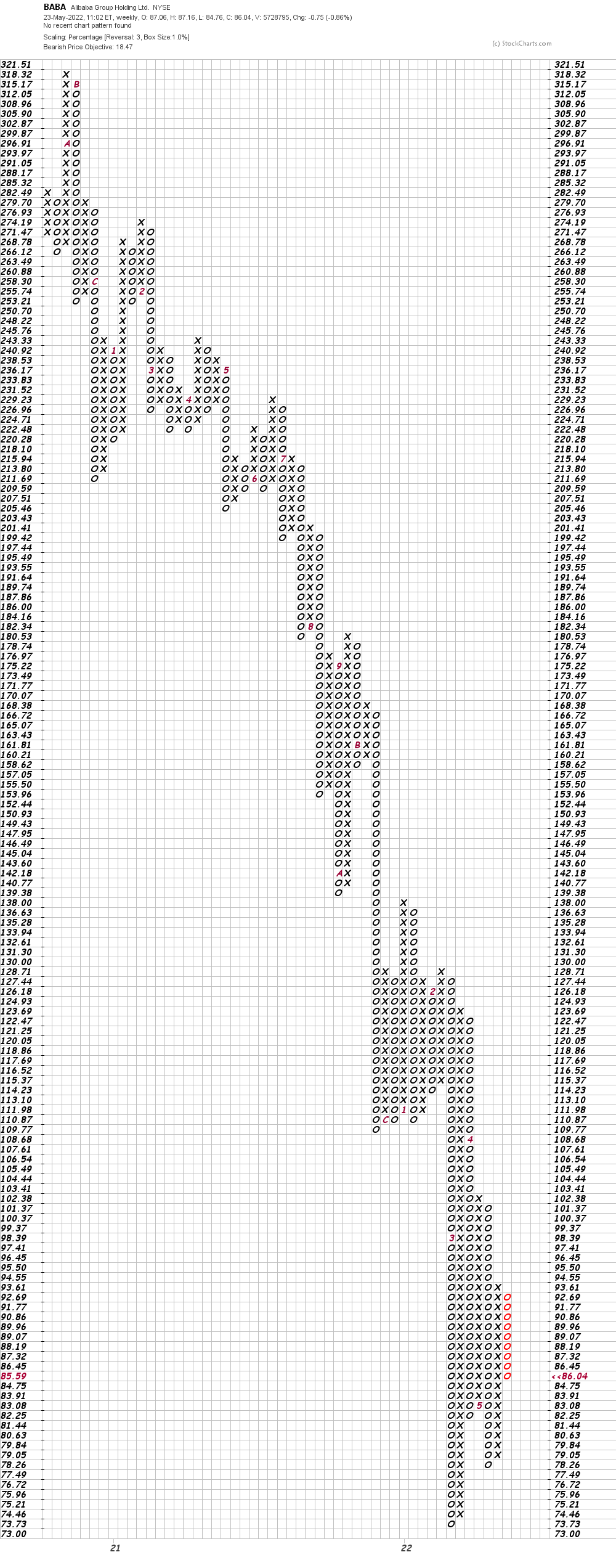

In this weekly Point and Figure chart of BABA, below, we can see a $19 price target.

Bottom-line strategy: Aggressive traders could go long BABA at current levels. Risk a close below $75 for now. Add to longs above $95 if desired. A rally to $135 is our target for now.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

[ad_2]Source link