Google backs Indian rewards funds startup Twid – TechCrunch

[ad_1]

Twid, an Indian startup working a rewards primarily based cost platform, has raised $12 million to scale its community of retailers and issuers and develop its answer within the South Asian market.

Rakuten Capital led the startup’s Collection A spherical, which additionally noticed participation from Google and current traders together with Sequoia Surge and Beenext.

Twid permits clients to pay at offline and on-line shops utilizing their current loyalty and reward factors from banks, fintech platforms, and e-commerce web sites. The Bengaluru-based startup’s companions embrace on-line grocer JioMart, pharmacy NetMeds, ticketing platform Yatra and music streamer Gaana.

“The issue has been quite simple and fairly massive throughout the globe, that individuals have gotten rewards from a number of locations, however they’ve primarily been very very like a locked asset,” mentioned Amit Koshal, founder and chief government of Twid, in an interview with TechCrunch.

Koshal based Twid with Rishi Batra and Amit Sharma in 2020 to construct a community impact platform for the plenty. The corporate claims to have amassed over 40 million registered customers.

Twid co-founders Amit Sharma, Amit Koshal, and Rishi Batra (from left to proper)

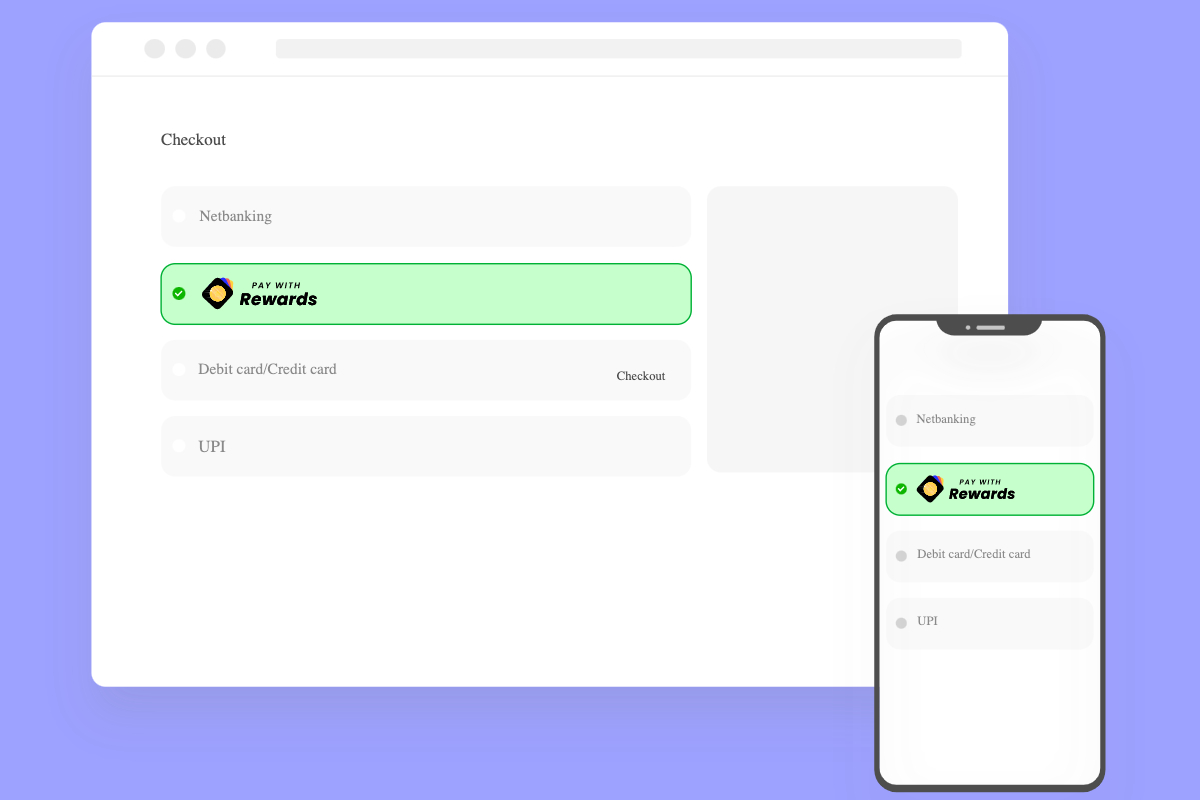

Twid brings a ‘Pay with Rewards’ possibility that’s accessible on the checkout web page of an internet retailer or at a retailer to let clients redeem their reward factors for his or her purchases. The reward factors, on this case, can come from a listing of issuers, and customers can decide which loyalty program or reward factors they want to redeem.

IndusInd Financial institution, Payback and InterMiles are a few of the key reward level issuers for Twid customers. The platform additionally fetches reward factors from Flipkart to let customers make funds utilizing their SuperCoins — the time period the e-commerce agency makes use of for its loyalty factors.

Twid claims that via its issuer companions, it supplies entry to over $1 billion in reward factors pool and has presence throughout over 50,000 retailers.

Koshal informed TechCrunch that Twid managed over 5 to eight p.c of the entire digital transactions of its service provider companions. The startup has additionally built-in its platform with cost gateways together with PayU, RazorPay and CCAvenue to supply the rewards point-based cost possibility on a number of on-line shops.

“The concept is that we will management 80% of all of the redemption that occurs within the nation,” Koshal mentioned. The chief additionally claimed that retailers are actively integrating Twid’s platform as it’s serving to them purchase clients at a low value — as a substitute of luring them into making purchases after giving reductions or cashbacks.

“We give a variety of intelligence again to our companions; what are the sorts of classes which can be doing good, what’s the common order worth that we’ve got elevated for you, what number of transactions per buyer that we’re rising for you,” Koshal mentioned, including, “Equally, from an issuer perspective, the issuer has good readability as a result of it’s their factors getting used.”

Twid additionally helps its issuer companions advantageous tune their choices by sharing which reward factors are making quick inroads with clients.

“Once we are built-in with all these issuers, we’ve got entry to over 300 million clients from them,” he mentioned.

Twid reveals a ‘Pay with Rewards’ choice to let customers pay utilizing their reward factors

Twid plans to make use of the recent funds to develop its community and go deeper into the enterprise, Koshal informed TechCrunch. “The second is that we need to construct an ideal moonshot expertise workforce. So, we’re rising in all departments,” he mentioned. The corporate presently has a headcount of 42 individuals.

The chief famous that there are plans to bolster the know-how and “make investments quite a bit” in knowledge science. Rakuten India CEO Sunil Gopinath is becoming a member of the Twid board of administrators on behalf of Rakuten Capital.

“Rakuten Capital sees large potential and future synergies on this funding. Given our world membership merchandise are developed right here in Bengaluru by Rakuten India, I’m thrilled to affix the Twid board of administrators and stay up for working with Amit Koshal, Rishi Batra, Amit Sharma and their very succesful workforce to rework the way in which reward factors are seen and utilized in India,” Gopinath mentioned in a ready assertion.

Twid plans to leverage Rakuten’s experience in reward factors to boost its platform.

“No matter their [Rakuten’s] experience is, from the sort of merchandise, platforms and many others, they’ve constructed, the ability that they’ve achieved, these are the learnings that we might be inculcating from them to construct a really robust enterprise in India to start with,” Koshal informed TechCrunch.

In a press release to TechCrunch, Rakuten Capital mentioned that it noticed an enormous market potential for Indian-based rewards enterprise alternatives, and Twid was properly positioned to make the most of this chance to construct and scale its enterprise mannequin.

“We’re additionally trying ahead to make accessible our tech expertise at Rakuten India who has been constructing Rakuten Group’s world reward program platforms to help Twid with creating best-in-class options for India,” the company enterprise capital arm of the Japanese firm mentioned.

In parallel with Rakuten, Google’s addition is predicted to assist Twid develop its mannequin of enabling clients to make purchases utilizing their a number of reward factors.

“Google has an extended historical past of investing in early-stage startups throughout a wide range of industries. And we’re very excited to collaborate with credible gamers like them within the journey,” Koshal mentioned.

In July final yr, Twid raised $2.5 million in funding led by Beenext and Sequoia’s Surge. “What we appreciated after we met the workforce and what stood out to us is that slightly than constructing out a closed loop system, they tried to make this factor fungible and create an open loop system,” Hero Choudhary, Managing Companion, Beenext, informed TechCrunch, whereas describing what made the Singaporean enterprise capital agency to help Twid since its early stage.

Source link